Дорогие читатели! Представляем вашему вниманию второй номер журнала «ЛОГИСТИКА» за 2025 г. Наша редакция, как и все наши коллеги, готовится к выставке TransRussia 2025 – крупнейшему мероприятию отрасли. В этом выпуске мы подготовили интервью с директором TransRussia Натальей Ломуновой, с которой беседуем о гибком подходе, новых участниках и цифровых сервисах.

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Despite the decline of foreign investors’ activity, the market demonstrates a positive trend

Russia’s real estate investment volumes increased by 24% YoY to more than USD1.6bn in H1 2019 compared to USD1.3bn in the previous year, says JLL. In this, Q2 2019 volume reached USD643m, 13% higher than in Q2 2018 (USD568m).

“Growth in H1 2019 can be explained by the closure of several large transactions. Increased stability in the financial markets and the CBR easing monetary policy are helping the recovery of real estate investment market activity,” – comments Natalia Tischendorf, Executive Board Member, Head of Capital Markets, JLL, Russia & CIS. – “Additionally, investor attention is attracted by the positive spread between current prime yields and bank financing costs in roubles, that appeared approximately one year ago for the first time in Russia real estate market. It is expected that the key rate will be cut further this year which will result in a further decline of interest rates for senior debt. This will positively affect the investment market.”

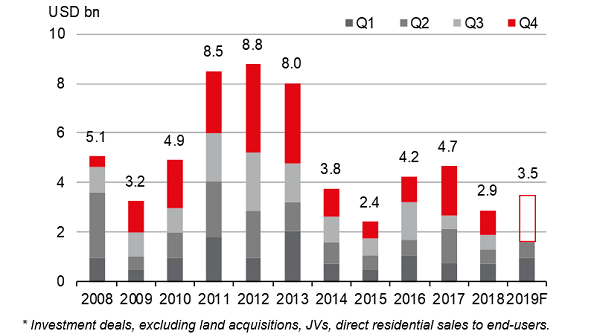

Russia real estate investment volume dynamics, USD bn*

* Investment deals, excluding land acquisitions, JVs, direct residential sales to end-users.

Source: JLL

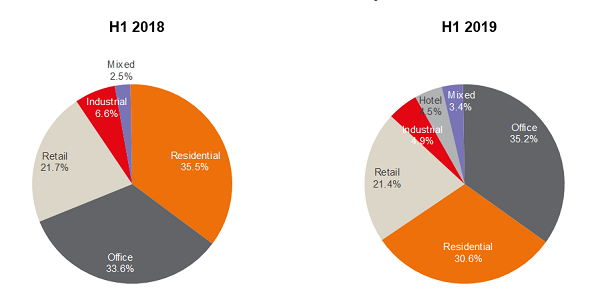

In H1 2019, the office sector received the most investor attention, with 35% of the total volume. The largest Q2 2019 office deals were the sales of building 3 in the office complex Aquamarine and the purchase of an asset portfolio in Moscow by Avangard bank. The residential sector (land plots for residential development and apartments under construction for investment) followed (31%). The largest deal in the sector was the purchase of the Moscow Fat Factory site in Tekstilshchiki for a residential project by PIK Group.

The retail sector completed the top-3, with 21% of the total volume; a vital part of retail investments was formed by investment company Bonum Capital that acquired the liabilities of Tsvetnoy central market from Sberbank.

Real estate investment volume by sector

Source: JLL

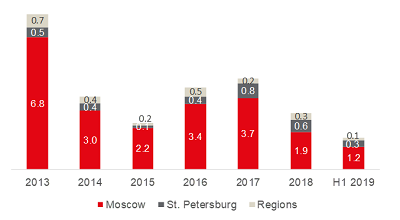

The Moscow share increased to 72% of the country’s volume in H1 2019 versus 56% in H1 2018 and the share of St. Petersburg remained at Q1 2019 level, 21% in H1 2019, compared to 38% in H1 2018. The share of deals with regional assets (outside Moscow and St. Petersburg) reached 7%, compared to 6% in the same period of last year.

Real estate investment volume dynamics by city, USD bn

Source: JLL

The share of external capital in H1 2019 investment volume decreased to 12% compared to 28% in H1 2018 due to the absence of public deals with foreign investors in Q2 2019. The decline in overseas investors activity in Russia correlates with the global trend of a decrease in foreign investments. The global volume of cross-border transactions declined by 17% YoY to USD44bn.

Olesya Dzuba, Head of Research, JLL, Russia & CIS, comments: “Russia market faces a shortage of real estate products available for purchase. Nevertheless, with increased stability and in the absence of external shocks, the recovery of real estate investment activity could intensify. Among the positive factors are rouble strengthening in H1 2019, reduction of inflationary pressure and the key rate cut to 7.5%. We still expect the 2019 investment volumes to reach USD3.5bn.”