Дорогие читатели! Представляем вашему вниманию второй номер журнала «ЛОГИСТИКА» за 2025 г. Наша редакция, как и все наши коллеги, готовится к выставке TransRussia 2025 – крупнейшему мероприятию отрасли. В этом выпуске мы подготовили интервью с директором TransRussia Натальей Ломуновой, с которой беседуем о гибком подходе, новых участниках и цифровых сервисах.

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

JLL presents the Q1 2018 operational results of the quality hotel markets in Moscow and St. Petersburg[1].

“The first few months of the year are always a relatively quiet time for hoteliers. First part of January suffers from impact of New Year & Christmas holidays, Moscow business activity begins to pick up in February, however, it is still too cold for leisure tourism in St. Petersburg, and only March is a full-fledged business month in the hotel industry when events resume and the business tourists flow increases,” - says Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS.

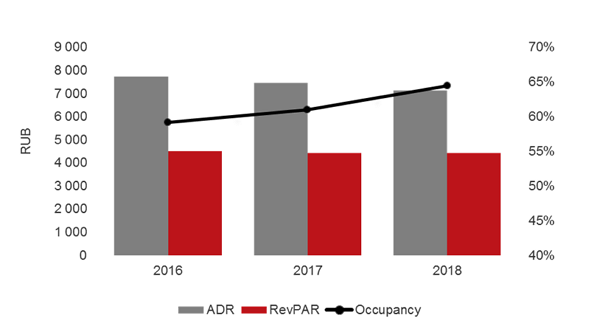

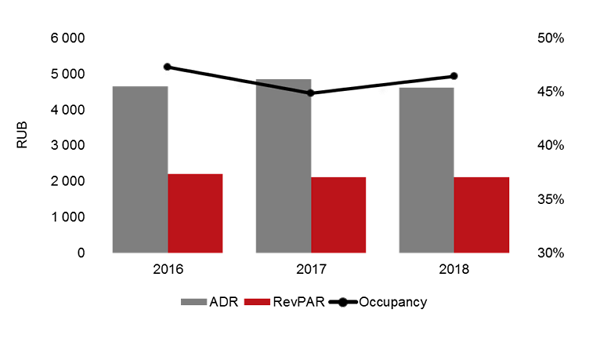

The demand for quality hotels grew in Q1 2018 both in Moscow and in St. Petersburg compared to the same period in 2017 against the background of a small drop in prices. “Occupancy in the Moscow market grew by 3.5 ppt to 65%, with a very slight decrease in ADR – by 4%, to RUB 7,100. St. Petersburg hotels were busier by 1.5 ppt (46% occupancy) vs. last year; nevertheless, the ADR fell more significantly, by 5% to RUB 4,600.” - comments Tatiana Veller. RevPAR in both cities remained at the level of last year - RUB4,400 in Moscow and RUB2,100 in St. Petersburg.

The most in demand segments of the Moscow hotel market in early 2018 were Upscale, where the occupancy reached 74%, and Economy (new segment for JLL analysis). The most inexpensive quality hotels (the average price per room in Q1 was RUB2,400) were 69% sold. Amusingly, ADR in the first quarter of the year in the Moscow Luxury segment was almost the same as for a full successful year 2017 – about RUB18,000.

Q1 Moscow quality hotel market results

Source: STR, JLL

In St. Petersburg, the Upscale segment was also a market leader in terms of occupancy - 58%, in the 2nd place – Upper Upscale with 53% of sold rooms. “It seems that management of these hotels began to practice the reverse policy to last year, when it was driving rates at the expense of occupancy,” – notes Tatiana Veller. – “Only the Midscale segment managed to grow rates (ADR increased by 11% compared to last year, to RUB 2400). At the same time, this segment also became the leader in occupancy loss in January-March (lost 2 ppt., to below 36%).”

Q1 St. Petersburg quality hotel market results

Source: STR, JLL

Since the beginning of the year, two branded hotels with 340 rooms have opened in the Russian capital - ibis Moscow Domodedovo Airport (150 rooms) and Holiday Inn Express Sheremetyevo (190 rooms), both in the airport areas. This year Moscow expects more than 2,000 new rooms; there is a reason to believe that most of them will be introduced in Q2. Although, no new hotels entered the market in the first quarter in St. Petersburg, the market expects 244 rooms in the economy segment – Holiday Inn Express Sadovaya.

"Two Russian capitals are preparing to receive teams, fans, staff, sponsors and journalists of the FIFA 2018, in the months ahead, until the peak in July, the number of the guests in championship cities promises to grow enormously. At the same time, a large increase in room stock is expected, even in quite mature markets such as Moscow, Yekaterinburg, Rostov-on-Don, and whether the major sporting event will bring explosive growth in the occupancy of quality hotels, is still in question.” - says Tatiana Veller.

[1] All statistics on operational results are sourced from STR with segments based on JLL configurations.