научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

The vacancy rate in main Moscow retail corridors approaches a pre-crisis level of 8%

According to JLL, the vacancy rate in main Moscow high street corridors reached 8.4% in Q1 2017, down by 1.2 ppt from Q4 2016 and by 4.1 ppt from Q1 2016.

This has extended the decline of the vacancy rate to four quarters. Premises vacated during the recession are gradually filling up, bringing the vacancy rate to the levels last seen in the beginning of 2014.

“Improving consumer sentiment is positively reflected in the retail turnover dynamics, which, in turn, affects the occupancy of main Moscow retail streets”, – comments Natalia Ozernaya, Deputy Head of Street Retail, JLL, Russia & CIS. – “A slight correction over the summer is possible on the central streets currently under reconstruction. But overall, we expect the vacancy to continue declining on the back of economic recovery and completions of the renovation of Garden Ring, Tverskaya and Petrovka streets.”

The first months of 2017 were marked by new openings on the central streets, which lowered vacancies in all locations. The largest drop was observed on B. Dmitrovka Street, where the vacancy rate halved in Q1, followed by Pyatnitskaya (down by 4.3 ppt) and Petrovka streets (-2.9 ppt). As a result, these streets became the most occupied in Q1, with only 4.3% of premises vacant on B. Dmitrovka, 4.5% on Myasnitskaya and 5.0% on Pyatnitskaya streets. Tverskaya Street remained the fourth most occupied at 6.4%, which was 1.3 ppt less than in Q4 2016.

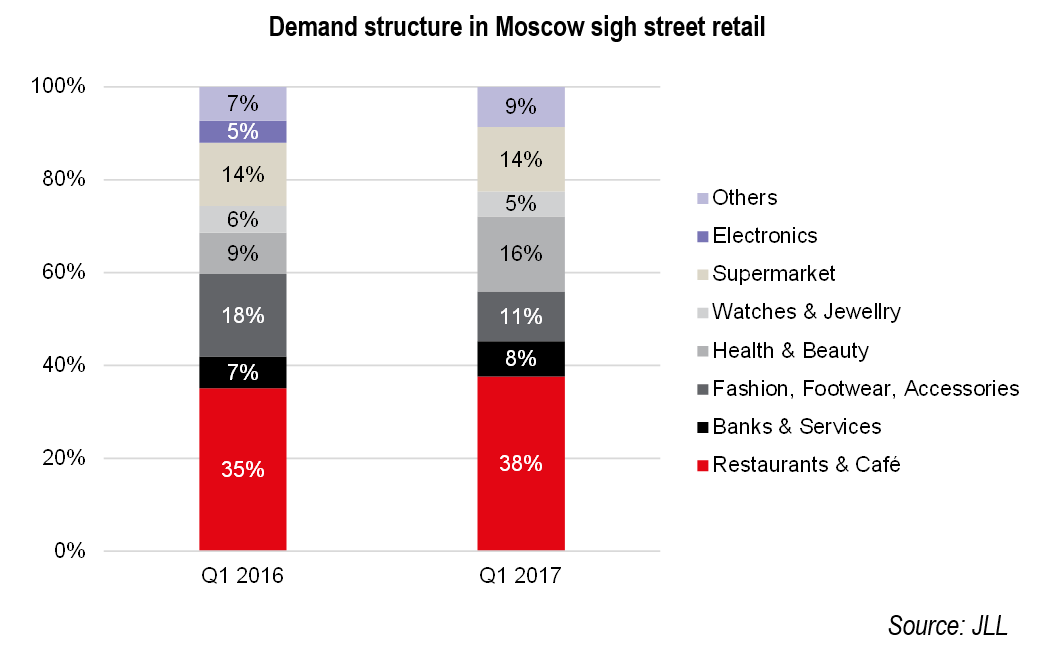

On the demand side, Restaurants & Cafés remained the leaders on the central corridors, with a 38% share of all leasing requests. Representatives of the Health & Beauty segment climbed to the second place, with 16% of all requests in Q1 2017 vs 11% in Q4 2016. The tenants in this category also expanded their presence on high streets by 2 ppt to 12% in Q1 2017. The improvements indicate that market participants have adjusted to new economic conditions.

The rotation[1] declined further in Moscow retail corridors, by 1 ppt to 5% in Q1 2017 compared to the previous quarter. The largest share of new tenants appeared on Nikolskaya (11%) and Petrovka (9%) streets, while the lowest indicator was seen on 1st Tverskaya-Yamskaya Street and in Patriarshie Prudy district[2] ,with 1% and 2% respectively.

“The most active tenants were Restaurants & Cafes (29%), Banks & Services (13%), and Health & Beauty (10%). Representatives of the first and the third groups opened their doors primarily on the central streets, while banks preferred locations on the Garden Ring”, – Ekaterina Andreeva, Retail and Investment Markets Analyst, JLL, Russia & CIS, notes. – In the Household segment, the most active player was the Moskhoztorg chain, which currently operates 24% of all Household category stores on the Moscow street retail market.”

Rental rate growth was observed on Novy Arbat (from RUB95,000[3] in Q1 2016 to RUB115,000 per sq m per year in Q1 2017) and Tverskaya (from RUB100,000 to RUB115,000 per sq m per year) streets. This trend indicates that the further rise in occupancy on the Moscow street retail market is expected in 2017 and shows tenants’ interest in recently renovated retail corridors.

[2]

We use here expanded Patriarshie prudy district: the area between Yermolayevsky Lane, Maly Patriarshy Lane, Spiridonyevsky Lane, Trekhprudny Lane and Bolshaya Bronnaya Street.