научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

2016 Moscow, Moscow Region and St. Petersburg Quality Hotel Market Results: A Year to Remember

JLL presents the 2016 results of the quality hotel market in Moscow and Moscow Region, and St. Petersburg.

Not only has the world lived through the major economic and political turbulences in the leap year of 2016, but the hotel scenery of the major Russian destinations has also changed drastically. 2016 has proven to be the truly unbelievable year for the hoteliers in two Russian capitals.

Several records to note for 2016:

• First time in history of observations all segments in Russia’s two main markets finished the year with YoY increases in RevPAR;

• First time in history of observation all Moscow hotel market segments finished the year with YoY Occupancy growth;

• Highest ADRs in 5 years recorded in all St.-Petersburg hotel market segments for the year;

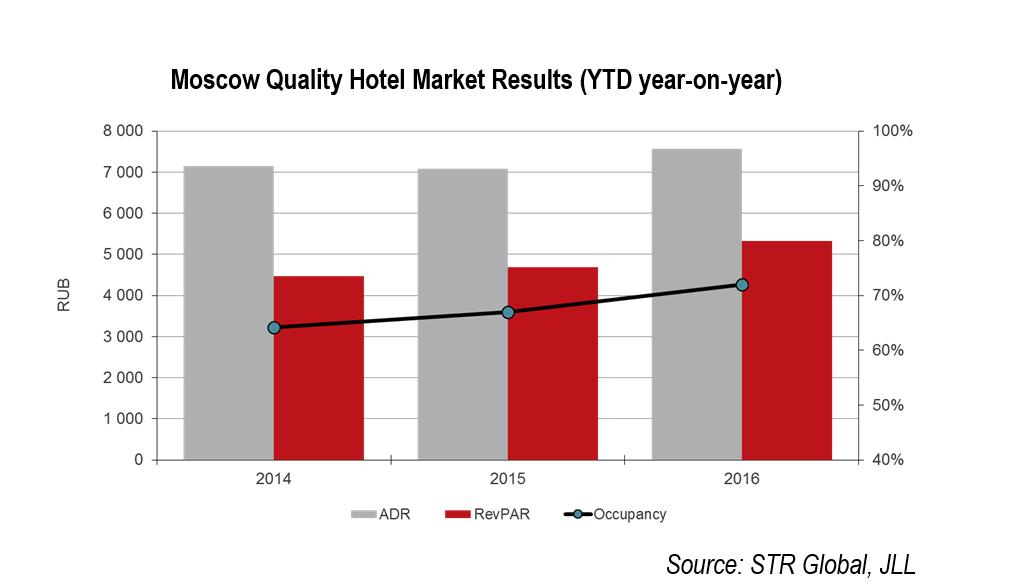

• Highest in 5 years average market-wide upward dynamics in Moscow in all three main operational indices YoY: Occupancy, ADR, RevPAR (7.4%, 6.8% and 13.7% respectively).

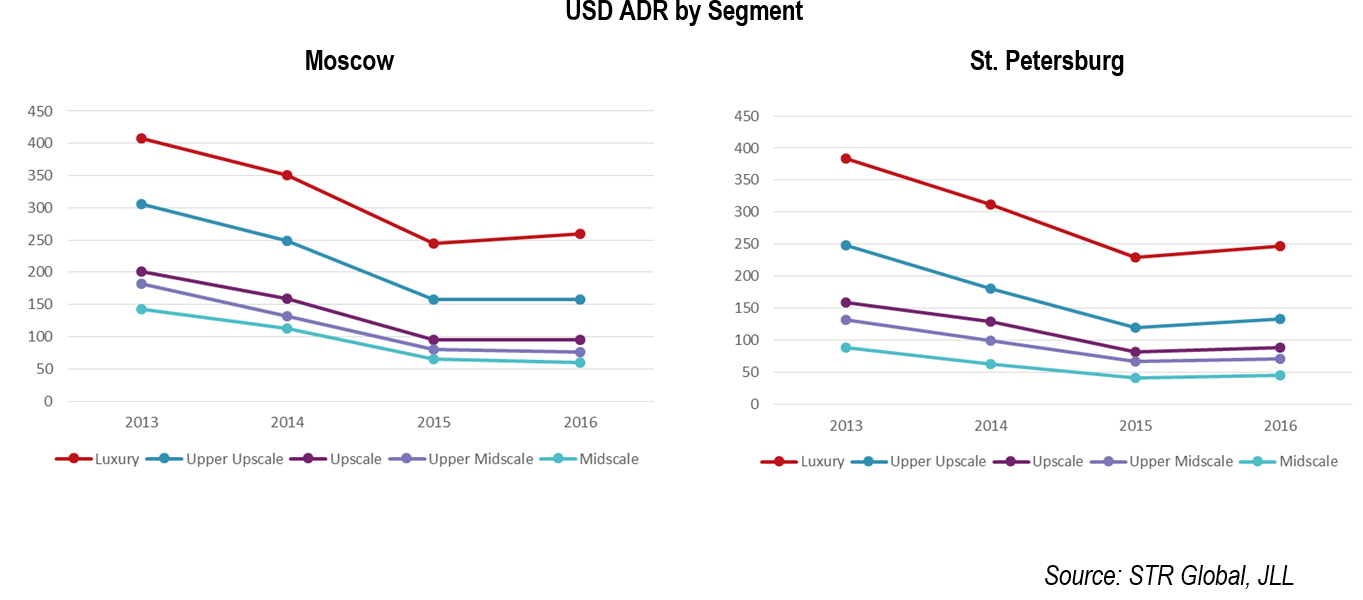

“We are also starting to see USD-denominated rates rebound.” – Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says. – “For most hoteliers who run quality room stock on both markets, 2016 brought the opportunity to start building up the rates, as the need to fight for occupancy seem to have evaporated. In St. Petersburg, ADR in all segments surpassed last year. In both Moscow and St. Petersburg RevPAR in all segments in USD surpassed 2015. In St. Petersburg, the Luxury segment USD RevPAR was even higher than in 2014.”

Operational Results

Moscow & Moscow Region

We can say that 2016 showed that the Russian capital definitely could support more midscale hotel rooms, based on the annual Occupancy numbers. In Upper Midscale the index even got close to 80%, representing growth of 3.6 p.p. YoY vs. 2015. Highest Occupancy growth, although, was recorded in the Midscale segment, with these hotels having received 7.6 p.p. more guests then in 2015, reaching almost 73%.

Leader in ADR growth was the Luxury segment, having reached RUB 17,100 per night (14.5%, or c. RUB 2,200 higher than last year). RevPAR dynamic was also led by hotels in the most expensive segment; their profitability grew by almost 18%, or RUB 1,700, to RUB 11,400. The only segment that slightly dropped rates as a result of 2016 was Midscale, having registered RUB 3,900 ADR vs. RUB 4,000 last year.

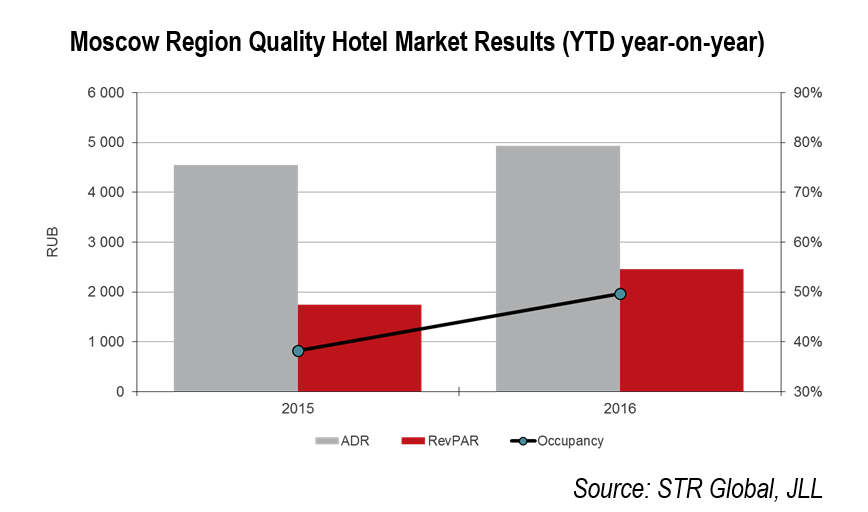

“Unprecedented gains in operating performance of the quality Moscow Regional recreational room stock were driven by the continued trend for localization of travel within Russia, which gave the hotels in this submarket an opportunity to receive more guests than ever, including the leisure tourists as well as some MICE which used to make use of cheaper foreign destinations.” – Tatiana Veller comments. – “As a result, a 50% occupancy year round (30%, or 11,5 p.p. higher than in 2015) and a small increase in rates (about RUB 400, to roughly RUB 5,000) and a resulting over 40% gain on RevPAR gave these accommodations a solid reason to call 2016 probably their best year ever.”

St. Petersburg

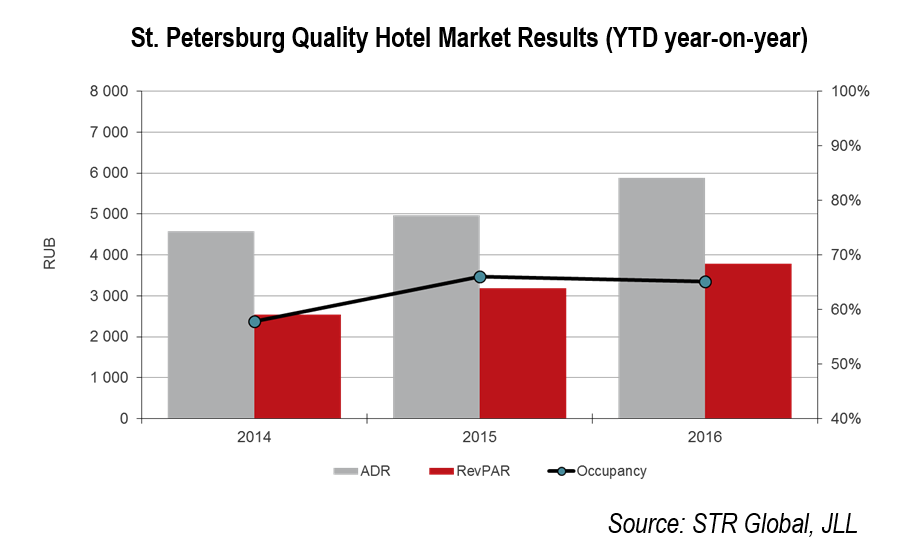

“2016 in the Northern Russian capital was about the quality at least as much as about quantity of guests and about managing demand and rate policies. Although the overall market-wide occupancy fell slightly (by 1 p.p., to 65%), but this was more than compensated by the 19% growth in ADR, to RUB 5,900, and as a result a 19% increase of RevPAR. Operation indices here were at record highs in rouble terms.” – Tatiana Veller notes.

In general, all segments of quality hotel market recorded at least a 15% ADR growth, with leader being the Midscale segment, where it grew by 21.3% YoY, to almost RUB 3,000. These market players were the recipients of the lower end of the mass tourism demand, and seems like this year they started to manage the quality of tourists they welcome, by raising prices, as the occupancy here fell as a result of this new policy by 4 p.p., to 62%.

Leader in RevPAR growth was the Upscale segment, where the index surpassed 2015 result by 24.3%, reaching RUB 4,300. Closely following was the profitability of market players in the Luxury segment – their RevPAR grew by 21.5% and reached RUB 9,700.

New Supply

Overall for Russia 2016 has been slower than 2015 in terms of new room stock entering the market – probably the function of the economic downturn of 2014-2015, and a resulting delay in delivering new projects. However, both in Moscow and St. Petersburg there was a higher number of new rooms then last year.

Of the predicted in early 2016 c.2,200 rooms, Moscow and the Region managed to actually welcome by the end of December over a half, or 1,231 new rooms. New entrants are: triple-brand by Accor on Kievskaya (Adagio, Ibis, Novotel), Ibis in Stupino (satellite of Moscow), Holiday Inn Moscow Seligerskaya (a rebranding from Iris Congress Hotel), and a 2nd phase of Radisson Resort Zavidovo with a wing of branded residences.

St. Petersburg was supposed to get about 400 new branded rooms in 2016, of which 314 actually opened – a rebranding of old Oktyabrskaya hotel near Moskovskiy Railway Station into a Best Western, and a new Hampton by Hilton Expoforum. A drop-off was Jumeirah, which is currently postponed with no clear date for opening.

“As the preparation for World Cup-2018 ramps up, there are yet more additional rooms announced by international and local hotel brands for 2017. Almost 3,500 should open in Moscow and the Region, and slightly less than 400 in St. Petersburg.” – Tatiana Veller comments. – “Some notable projects to watch out for are: Hyatt Regency Petrovskiy Park (2nd Hyatt in the Russian capital, a part of VTB Arena Park, large-scale development by VTB), a rebranding of the old soviet Belgrade hotel near Foreign Affairs Ministry in Moscow into Azimut (complete revamp of the building, which investor managed to fulfill in an extremely short period – about 18 months, contingent on the date of actual opening), as well as a 2nd hotel by the Korean brand Lotte, which will start welcoming guests in St. Petersburg this year.

Investment Market

This has been a year of M&A, not only in the world (Accor-FRHI, Marriott-Starwood deals, to name just the largest), but also for Russia. Several transactions to remember from 2016:

• Acquisition of the House-Book building on New Arbat, 15 by structures affiliated to Capital Group for redevelopment into a hotel/mixed-use scheme;

• Purchase by the Kievskaya Ploschad’ owners of Varvarka, 14 project near Park Zaryad’e for completing construction of a Luxury Hotel;

• Acquisition of a portfolio of 9 hotels by Sistema JSFC from the Regional Hotel Chain.

On several trophy assets that have been put up for sale earlier, 2016 brought commencement of active discussions with some potential buyers, but no final agreements are reached.

2017 Projections

2017 will display the influence of several major factors, which we are expecting to re-activate hotel development and shower the market with new signings and openings:

• slowly but surely restoring confidence in oil price, rouble strength, and stabilization of Russian economy, with some ripple effect on surrounding countries;

• sustained high volumes of domestic tourism;

• preparations for the Football Cup – 2018, to be held in 11 cities around Russia.

“There is an unusually high number of nearly 4,000 new hotel rooms, forecasted for 2017 in just Moscow and St. Petersburg. This highly active pipeline is supported by the signs of stabilization of economy, and cautious optimism in predicting small GDP growth and inflation fall for 2017. Investors seem surer of the future than ever in the last three years.” – Tatiana Veller says. – “This should additionally stimulate further consolidation of hotel portfolios in hands of larger players, as well as unfreezing and starting of some new projects.”

“Moscow and St. Petersburg hotel market players in 2017 should continue to sit comfortably on their achievements of 2016, as no major changes in foreign or domestic policies can now be predicted, which means that demand patterns should stay similar to those in 2016. At some point, the growth should slower, but the gradual recovery of the USD-denominated rates in higher segments can still be expected.” – Tatiana Veller concludes.