научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

Commercial Real Estate Investment Activity Set to Rebound in 2017

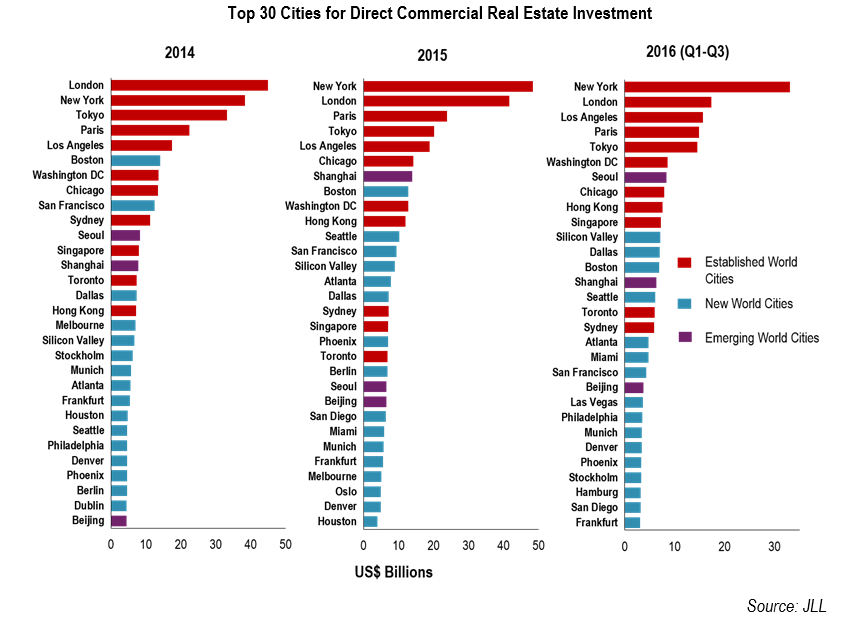

New World Cities featured strongly among top 30 global investment markets

CHICAGO, MOSCOW, 20 January, 2017 – Despite economic uncertainty and geopolitical challenges, commercial real estate investment activity remains robust and is anticipated to rebound in 2017 according to new analysis by JLL. In fact, global investment volumes are projected to climb back toward $700 billion this year, up from $650 billion in 2016 and returning to levels last recorded in 2014 and 2015.

Investment activity in the United States, the world’s largest real estate market, is strong. It’s the home to 16 of the top 30 cities for real estate investment in 2016:

• New York was the global leader (for the second year in a row), with over $33.1 billion in transactional volumes (Q1-Q3 2016), nearly double the activity of second place London.

• Los Angeles moved into third position (ahead of both Tokyo and Paris), with a 22 percent increase over the first nine months of 2016 to $15.7 billion, due to an increase of foreign investment.

• By contrast, San Francisco dropped out of the Global Top 12 for investment, having occupied one of the top global positions for several years, with investment levels dropping 46 percent (Q1-Q3 2016) against 2015.

• Washington DC (6th) and Chicago (8th) held their positions in the Global Top 12 despite modest falls in volumes in 2016.

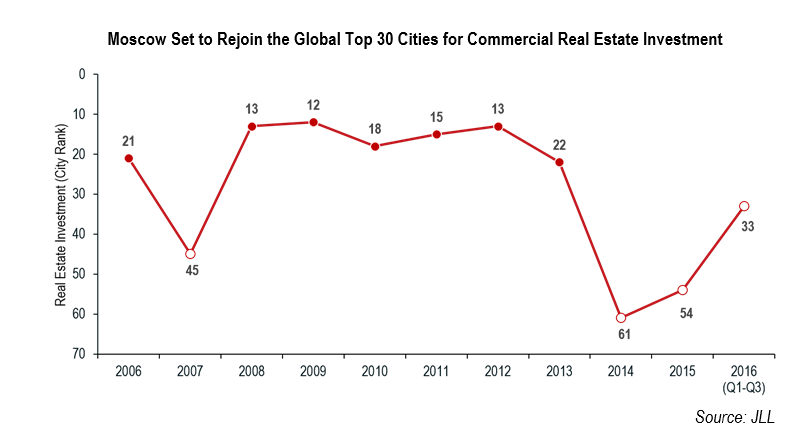

Moscow is outside Top 30 Cities. However, the Russian capital has improved its result in 2016 – the city is ranked 33rd vs. 54th in 2015. “In 2008-2013, Moscow had made consistent appearances in the Investment Top 30 thanks to high yields, growing asset prices, and dynamic real estate market. As a result of economic recession, Moscow fell out from Top 30 in 2014 to 61st place, but it has since been gradually regaining its position thanks to economic and rental market stabilization, as well as growing investor interest.” – Vladimir Pantyushin, Head of Research, JLL, Russia & CIS, notes. – “In fact, Moscow is one of only four Emerging World Cities – together with Shanghai, Beijing and Seoul – that have been regular features of the Investment Top 30 over the past decade.”

New investors, new capital

The global trend is supported by increased institutional allocations directed toward commercial real estate as they are focused on higher-yield opportunities, in addition to new sources of capital that are being unlocked around the world from countries like China, Taiwan and Malaysia.

“New capital targeting real estate is only part of the story; experienced real estate investors are also allocating more money to direct real estate opportunities,” said David Green-Morgan, JLL Global Capital Markets Research Director. “As these groups tend to be well versed in allocating capital, they are able to direct large sums of money into the sector relatively quickly.”

According to JLL, by 2020, cross-border investment globally could account for more than 50 percent of all activity as inter-regional flows grow.

One of the most striking trends in commercial real estate is the rise of China as a major player in global real estate markets. As of the third quarter 2016, China overtook the U.S. as the world’s largest cross-border purchaser of commercial real estate assets.

Real estate reigns as a global asset class

The last two real estate cycles have seen an extraordinary rise in the amount of capital targeting the asset class across the world. Growth in the sector over the last 10 years has been impressive, but real estate still lags behind the bond and stock markets in terms of total U.S. dollars.

To continue its rise as a preferred asset class, a further improvement in transparency is essential. JLL’s 2016 Global Transparency Index pointed to steady improvement in the majority of countries, which is an encouraging sign for investors.

Competition benefits New World Cities

As increased demand has placed stress on core urban assets in cities like New York, London and Paris, competitive pricing and lack of product in the marketplace has investors looking to “New World Cities.” This group is comprised of mid-sized cities which typically excel in high-tech and high-value sectors supported by robust infrastructure, a favorable quality of life and transparent business practices, which combine to boost momentum and real estate market activity.

In the U.S., New World Cities include metropolitan areas like Boston, Dallas and Seattle, while in Europe cross-border activity has boosted investment volumes in cities such as Stockholm, Brussels, Oslo, Vienna, and Dublin.

A changing geography on investment?

“Despite the fact that there are more cities than ever on investors’ radars, they continue to be overwhelmingly focused on the more transparent and liquid cities in the mature economies,” said Jeremy Kelly, JLL Director, Global Research. “There are huge opportunities for emerging cities to capture a greater proportion of capital directed at real estate but, to do so, they will need to significantly improve transparency in order for investors to continue to gravitate toward the established investment market.”