научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

28 ноября в Москве в отеле «Золотое кольцо» прошел XI форум «Склады России: итоги года!».

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

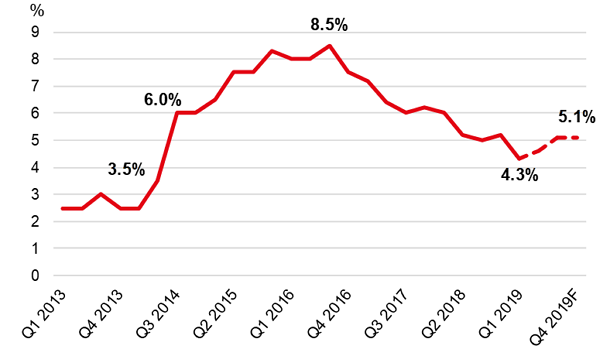

Vacancy rate in Moscow shopping centres approached 4%

According to JLL, the vacancy rate in Moscow shopping centres declined to 4.3% in Q1 2019, which is the lowest level since the middle of 2014.

This was a result of low completions in 2017-2018, when only eight new schemes (278,000 sq m[1]) entered the market; the figure is half the level of new shopping centre deliveries in 2015-2016. A lack of new supply and a high occupancy rate of new shopping centres have led to the decline in the vacancy rate by 1.7 ppt YoY and 0.8 ppt QoQ.

“The amount of vacant space has decreased in more than a third of shopping centres over the past year,” – comments Polina Zhilkina, Head of Retail Advisory, JLL, Russia & CIS. – “However, there are projects on the market with considerable higher level of vacancy – about 20-50%, which is caused by drawbacks in location and accessibility, inefficient concepts, or the structure of key tenants. In this case, the detailed analysis of current situation will help to find weaknesses and to work-out the re-conception plan.”

Some 320,000 sq m announced for 2019 indicates the beginning of a new cycle on the market. Among new schemes for 2019 are Salaris MFC (110,000 sq m), Ostrov Mechty SC (65,000 sq m), Novaya Riga Outlet Village (38,000 sq m) and several neighbourhood shopping centres of ADG Group. Taking into account completions in 2019, the vacancy rate is projected to rise to 5.1% by the end of 2019.

Vacancy rate in Moscow shopping centres

Source: JLL

“The recovery of development activity in Moscow is accompanied with the transformation of the tenant mix and shopping centre formats. The future pipeline is dominated by neighbourhood centres with a greater focus on entertainment and kids’ zones, as well as centres built within transport hubs. Shopping centres are diversifying their tenant mix to remain competitive. They are adding operators of non-retail formats such as co-working space, various services, fairs, pop-up and shop-in-shop stores,” – says Ekaterina Zemskaya, Head of Retail Group, JLL, Russia & CIS. – “In addition, they continue increasing the share of F&B and entertainment segments as it generates additional footfall and forms customer loyalty. The total share of leasable area of those operators in Moscow’s top shopping centres has gone up to 20% from 8% over the past ten years.”

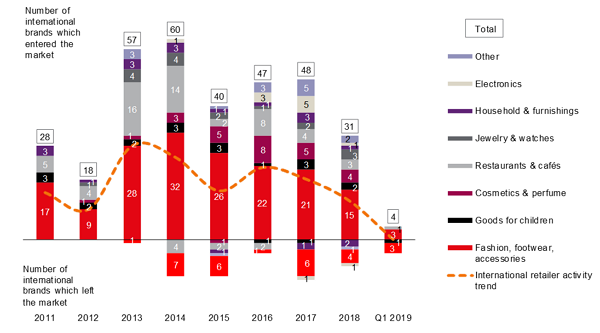

The number of new international retailers declined significantly in Q1 2019, with only four brands entering the Russian market versus ten in Q1 2018. The lowest level of new entrants was recorded in Q1 2015, when there were only two newcomers. It is worth mentioning that the number of brands that have left the Russian market during the first three months of 2019 equals the number of new ones.

The low level of activity was caused by a lack of quality space in shopping centres, as well as in key street retail locations suitable for flagship stores. In 2019, a number of international brands are expected to enter the Russian market. Among them Urban Revivo, perfume brands Le Labo and By Kilian, and also H&M Group project & Other stories is expected to open its first store soon.

Retailers on the Russian market: entries and exits

Source: JLL