научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

Leningradsky becomes closer

The launch of new metro stations will improve transport accessibility of the Leningradsky Business District

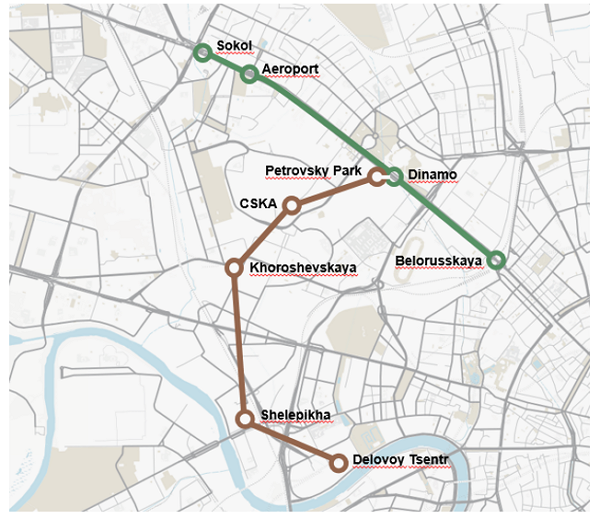

The launch of the first section of the Third Interchange Contour (TIC) is expected before the end of the year. It includes five new metro stations: Delovoy Tsentr in Moscow City, Shelepikha, Khoroshevskaya near Polezhaevskaya metro station, CSKA and Petrovsky Park in the Leningradsky Business District (LBD).

In this report we analyze how new CSKA and Petrovsky Park stations may affect offices located in the LBD. We divide the key LBD business centers into two groups on the basis of their proximity to metro stations and compare the differences in vacancy and rental rates.

TIC and Zamoskvoretskaya line metro stations

Source: JLL

The launch of CSKA and Petrovsky Park metro stations will improve transport accessibility of business centres within the LBD. CSKA station will open at a walking distance from Aerodom BC, Arcus BC (phase II, III), and Faces MFC announced for 2018. Adjacent to Dinamo station, Petrovsky Park will not affect the nearby business centres directly but it will connect the LBD with Moscow City and other parts of the city in the future.

Transport accessibility: no limit to perfection

The LBD is one of the most demanded Moscow submarkets among international tenants: from 2010 to Q3 2017 their share in the total Class A take-up exceeds the same figure in the CBD which is traditionally popular among foreign players (48% versus 36% accordingly). The strong tenant interest appears to be driven by high transport accessibility of the submarket. The LBD is serviced by Zamoskvoretskaya metro line stations and Leningradsky Avenue, one of the major Moscow highways leading to the Sheremetyevo airport.

Metro as a blessing

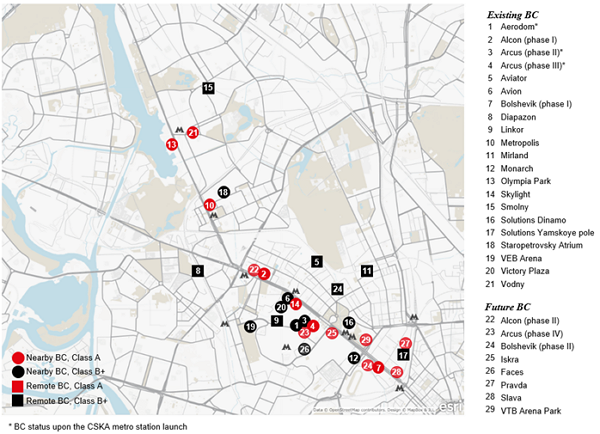

Notwithstanding the good transport infrastructure level, vacancy rates in the LBD are sensitive to metro station proximity. To identify this, we split Class A and Class B+ office buildings into two categories, nearby (business centres located within a ten-minute walk, or up to 850 m) and remote.

Key LBD business centres

Source: JLL

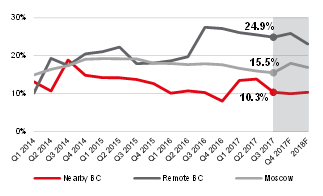

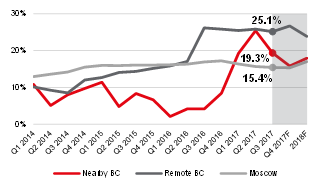

Office occupancy levels depend on metro station proximity. In the past year, the overall vacancy rate in the nearby buildings was in the range of 8-14%. In Q3 2017, it reached 10.3%, 5.2 ppt lower than the market average. Despite 35,000 sq m of office space coming to the market next year, the vacancy rate in the nearby buildings will stay flat. About 26% of the expected volume has already been pre-let and pre-sold. Considering traditionally high interest to quality LBD projects we expect this practice to continue, noting that 67% of pre-let and pre-sold office space in Moscow since 2010 was in the nearby buildings.

Overall vacancy rate dynamics in the LBD and Moscow (excluding Class B- office buildings)

Source: JLL

In remote buildings the vacancy rate is significantly higher, exceeding the Moscow average (24.9% against 15.5% in Q3 2017). It is anticipated to ease to 23.1% in 2018 after reaching a 27.5% peak in Q3 2016. Such a decline will be caused by a lack of new supply and by three office buildings – Aerodom BC and Arcus BC (phase II, III) – moving to the group of nearby buildings upon the CSKA metro station launch.

Our exercise shows that the LBD vacancy rates vary with the metro station proximity. The share of vacant space in office buildings located more than 850 m away from a metro station is almost twice the market average. Tenants prefer nearby buildings, even at the construction stage.

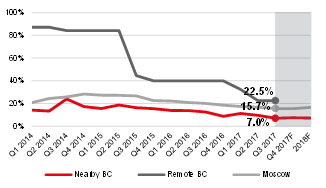

Class difference

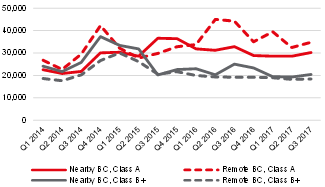

The contrast between the two groups of office centres is stronger when they are split by class. Class A nearby buildings are in high demand and consistently show the lowest vacancy rate levels (at 7.0% in Q3 2017). Developers of Class A offices also display a clear preference by constructing business centres near metro stations. There is only one Class A building within the LBD limits, Arcus BC (phase III), located beyond a walking distance from a metro station. Even there, the CSKA station launch will improve the transport accessibility, bringing the metro within a walking distance and shifting Arcus BC (phase III) to our nearby group. This will likely attract new tenants (currently 22.5% of the offices premises are vacant).

Class A vacancy rate dynamics in the LBD and Moscow

Source: JLL

In the remote group, Class B+ office buildings dominate in square metre terms: Class B+ vacant space is ten times the vacant space in Class A, even though there is minor difference between vacancy rates by class.

Looking forward, the main improvement is expected in the buildings located close to metro. Even in well performing Class A offices the vacancy rate will likely continue to drift lower. In Class B+ the improvement will likely be more prominent, with the vacancy rate in the nearby buildings declining from the current 19% to around 15% market average by the end of the year. This will be driven by the CSKA metro station launch and infrastructure development (including a park opening near Khodynskoye Pole). We also anticipate CSKA to positively impact the occupancy rate in VEB Arena MFC, the project completed last year and currently accounting for a large part of the overall Class B+ vacancy. We expect the vacancy to decline in 2018, following the improvement in transport access and territory development.

Сlass B+ vacancy rate dynamics in the LBD and Moscow

Source: JLL

Overall, the link between the vacancy rate and metro station proximity is typical for Class A and Class B+ office buildings. In the LBD, metro proximity is one of the key parameters boosting demand for its premises.

Future projects (Alcon BC (phase II), Arkus BC (phase IV), Bolshevik (phase II), VTB Arena Park) also demonstrate a growing demand for quality buildings within a walking distance from metro.

Rental rates: subject to negotiations

Rental levels are less effected by metro station proximity. Both Class A and B+ asking rates in nearby and remote buildings are at similar levels. Differences in rental rates are reached during negotiations.

Asking rental rate dynamics

Source: JLL