научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

E-commerce has driven Q3 warehouse take-up in Moscow Region by 54%

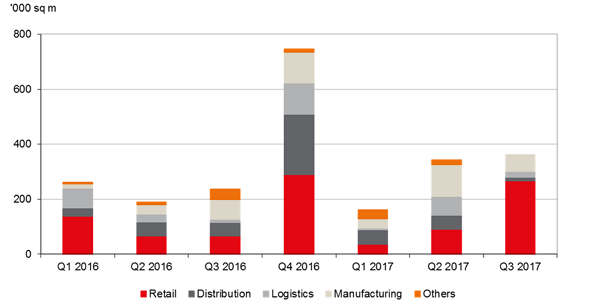

According to JLL, warehouse take-up in Moscow region amounted to 362,000 sq m in Q3 2017, 54% above the level in the same period of last year. The year-to-date take-up totaled 864,000 sq m, 26% higher than in 9M 2016.

More than half of Q3 2017 take-up was formed by the two record transactions with e-commerce retailers. Utkonos bought 70,000 sq m in Logopark Sever - 2 and Wildberries signed a built-to-suit distribution center contract with A Plus Development for over 145,000 sq m. In addition, an e-tailer Gala-Centre leased 23,000 sq m in Tomilino.

Demand distribution by business sector in the Moscow Region

Source: JLL

“Large deals of online retailers on the warehouse market is the sign of a new stage in the development of this sub-segment, for which a warehouse is an important part of the business,” – says Oksana Kopylova, Head of Retail and Warehouse Research, JLL, Russia & CIS. – “The size of these transactions reflects the importance of scale in e-commerce. Minimizing logistics costs per order is essential, and the best way to achieve this is to maximize the size of the distribution center. The deals mark a new level of competition in Russian e-commerce; until recently, a typical online retailer deal was 5,000-10,000 sq m.”

One more active business sector in 9M 2017 has been manufacturing companies (24%), which also prefers long-term solutions and evaluate opportunities for construction of customised buildings, both logistic and industrial.

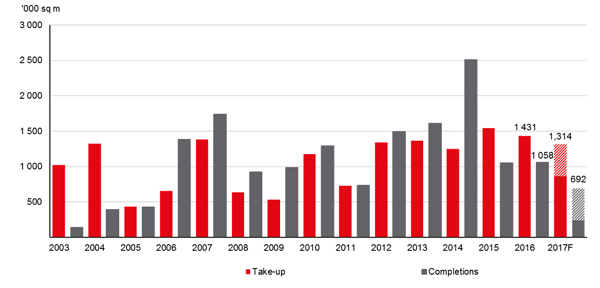

“We are seeing a trend of business consolidation. It is already quite advanced among retailers, and the scale factor is extending this to many other business segments. In turn, this generates large warehouse deals, over 50,000 sq m,” – observes Viacheslav Kholopov, Regional Director. Head of Warehouse & Industrial Department, JLL. – “We expect that 400,000-500,000 sq m space will be absorbed until the end of the year. As a result, the annual take-up will reach 1.3-1.4 m sq m.”

Moscow Region warehouse take-up and completions

Source: JLL

Warehouse completions in Q3 2017 were 35,400 sq m. Only two objects entered the market, in Logopark Dmitrov (25,600 sq m) and in the Logopark Sever – 2 (9,800 sq m). Thus, 9M 2017 warehouse completions amounted to 235,000 sq m, which is 74% less than in January-September 2016.

“Despite lower completions, the development activity can be described as stable. About 458,000 sq m are scheduled for delivery in Q4, which will bring the annual figure to 700,000 sq m. Although this will be 35% lower than in 2016, the number is high if taken against the large volume of available vacant premises,” – comments Viacheslav Kholopov. – “In addition, two large developers announced new projects that will maintain active construction in the near future. PNK Group has declared two new industrial parks, PNK Park Zhukovsky (500,000 sq m) and PNK Park Novaya Riga (300,000 sq m), while Logopark Development plans to launch the construction of Logopark Zapad (400,000 sq m).”

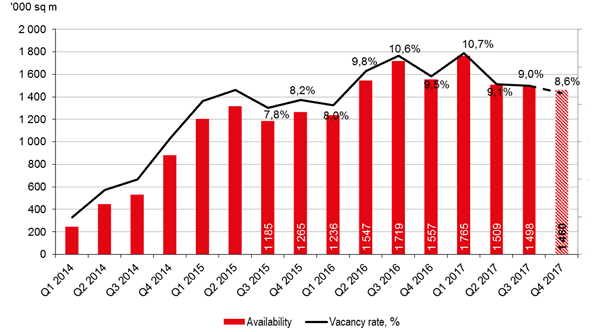

The vacancy rate on the warehouse market reached 9% at the end of Q3, 1.5m sq m against the total stock of 16.6m sq m . The vacancy rate has declined by 0.1 ppts in Q3. Despite large new projects delivery in Q4, JLL analysts expect high demand, both primary and secondary, to reduce the vacancy rate further, to 8.6%.

Available warehouse space dynamics in Moscow Region

Source: JLL

“The presence of 1.5m sq m of vacant space will continue to pressure rental rates and sale prices. This results in a wide variety of suitable premises for prospective tenants and buyers,” – added Viacheslav Kholopov. Average asking rental rates in the warehouse market of the Moscow region in the new deals are at the lowest level and remain in the range of RUB3,000-3,600 sq m per year (triple net).

Actual rents depend on specific location and proximity to MKAD. Object quality is also important, and older buildings (over seven years), which have not been upgraded or reconstructed may be offered at lower prices, affecting the averages.