научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

Moscow shopping centre market shows lack of quality space

Amid low completions, the vacancy rate declined to 6%

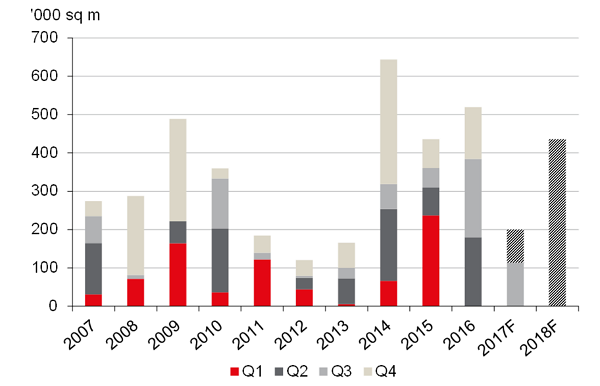

MOSCOW, October 4, 2017 – According to JLL, only one shopping centre with a GLA of 125,400 sq m entered the Moscow market in Q3 2017 – Vegas Kuntsevo. With no deliveries in H1 2017, this represents the total completions in the first nine months of 2017, two-thirds lower than in the same period of last year.

Vidnoe Park (45,000 sq m), Milya (21,000 sq m) and Petrovskiy (8,500 sq m) as well as the retail part of Fili Grad multifunctional complex (12,000 sq m) are announced for delivery in Q4 2017. The annual Moscow completions will be at about 200,000 sq m, the lowest level in the past four years, and 62% down vs 2016. Arena Plaza (20,000 sq m) and Galeon (14,000 sq m) are among projects expected later this year but rescheduled for 2018.

Shopping centres completions in Moscow

Source: JLL

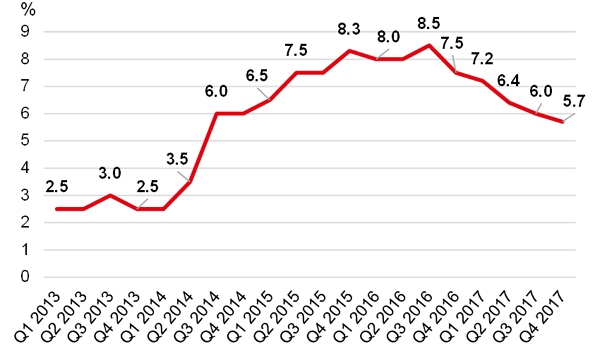

The vacancy rate in existing quality shopping centres in Moscow declined from 6.4% in Q2 2017 to 6.0% in Q3 2017, down by 2.5 ppt from Q3 2016.

The structure of vacant premises in Moscow shopping centres remained unchanged from the beginning of the year. The delivery of new Vegas Kuntsevo superregional shopping centre has not influenced the market vacancy structure, due to its high occupancy rate (85% at the moment of opening).

Vacancy rate dynamics in Moscow shopping centres

Source: JLL

Ekaterina Zemskaya, Regional Director, Head of Retail Group, JLL, Russia & CIS, comments: “The Moscow market shows signs of a deficit of quality retail premises. Seeing a record low volume of new construction, the vast majority of professional operators are forced to develop their chains in existing shopping centres. At the same time, the situation is completely different from the one two years ago. In the period of high developer activity in 2014-2015 and the economic downturn, shopping centres were opened with the occupancy rate of 40-50% from GLA. Now, there is a shortage of new retail premises to maintain the growing retailer demand. As a result, even in the shopping centres are expected to open the next year – for example, the ENKA TC project on Kashirskoe Highway – the occupancy rate already exceeds 80% from GLA.”

Taking into account the lack of a new retail supply, JLL analysts expect the vacancy rate to decline further, to 5.7% by the end of the year, the lowest level since the beginning of 2015. The prime vacancy rate, that is in the most successful shopping centres with high footfall and conversion rate, remains close to zero for over a year.

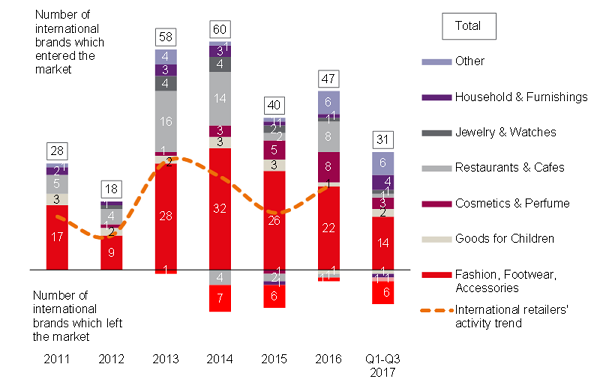

“Only six new brands entered the Russian market in Q3 2017; five of them opened their first stores in Moscow, while Samara has seen one new opening, of Kazakh Mimioriki. Half of the newcomers represent premium and luxury segments: two fashion stores representing the premium segment, Barracuda and Hanro, appeared in GUM and one Italian children apparel boutique representing luxury segment, Il Gufo, emerged in Petrovsky Passage,” – notes Oksana Kopylova, Head of Retail and Warehouse Research, JLL, Russia & CIS.

The number of entries of new international retailers over the first three quarters (31) is comparable to the level of 9M 2016, when 37 new brands entered the Russian market.

Six international retailers left the market in Q3 2017: Debenhams, Mamas&Papas, LeEco, C&A, Mexx, and Accessorize. Decisions to close down last monobrand store were predominantly caused by changes in market strategy, brand portfolio optimization, or by business diversification.

Retailers on the Russian market: entries and exits

Source: JLL

Rents for a retail gallery unit of 100 sq m in shopping centres remained stable in Q3 2017: prime rent was at RUB195,000 per sq m per year, average rent at RUB74,000 per sq m per year.