научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

The share of foreign investments into Russian real estate increased in 2017 compared to the same period of 2016

- Capitalization rates in all segments of commercial real estate have experienced decrease for the first time since 2014 -

- The volume of investments in 2017 can surpass the result of 2016 and amount to about $5 billion –

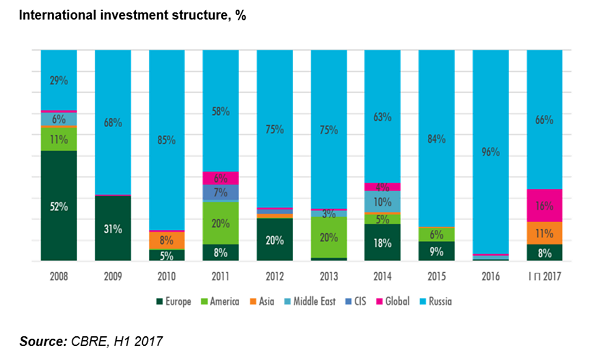

The share of foreign investments into Russian real estate increased from 4.6% in the H1 2016 to 34% in the same period of 2017, according to the latest data from global real estate advisor, CBRE. At the same time, the share of Asian companies was 11% in the structure of the total volume of investments that is historically the highest for Russian market.

In the H1 2017 $1.6 billion was invested into Russian real estate, which is 36% lower compared to the same period last year ($2.5 billion) and 15% higher than the amount invested in the first six months 2015 ($1.4 billion). However, excluding the largest Q1 2017 purchase transaction with governmental company which bought an office building in MIBC Moscow-City, that has formed 40% of H1 2017 transaction volume, H1 2017 increase on previous year is only 6%.

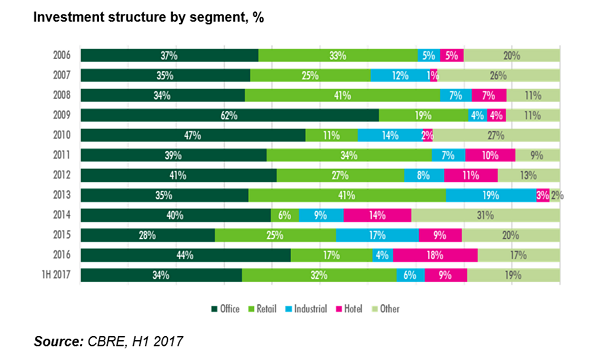

The most attractive for investors in H1 2017 were office and retail real estate segments, which accounted for 34% and 32% respectively. The retail real estate segment significantly increased its share in the investment structure in the H1 2017, increasing by 30 ppts. compared with the value of the H2 2016 (2.5%) and for 15 ppts. compared with the value for the entire 2016. The key deals were the sale of Vozdvizhenka Center and Legion II, as well as the two shopping centres: Leto (saint-Petersburg) and Gorbushkin Dvior in Moscow.

An average deal size decreased by 36% in H1 2017 and amounted to $38 million against $60 million in H1 2016.

Central Bank policy on key rate decrease (in H1 2017 the rate has decreased from 10% to 9%) has influenced the cost of loan financing. Based on this further real estate capitalization rates compression is possible by the year-end. In H1 capitalization rates has experienced a slight decrease to the level of 9.75% for offices. 10.00% for retail and 12.50 for quality warehouse assets.

Against the background of the Russian ruble and oil prices stability, as well as the economy's exit from the recession, investment activity in the real estate market is increasing. As a result, the volume of investments in 2017 can surpass the result of 2016 and amount to about $5 billion.

Irina Ushakova, Senior Director, Head of Capital Markets Department, CBRE in Russia, said:

“The most important event in H1 2017 is the decline in capitalization rates in all segments of commercial real estate. This is the first time since 2014. We expect that this compression will be a positive signal for investors and potential buyers’ interest will be converted into deals by the end of the year. Thus, large transactions with foreign capital were closed in the first half of this year, and further stabilization of the market will at least maintain the share of foreign investments in the total volume of transactions."