научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

New office delivery volumes in Moscow are postponed to the second half of 2017

- Vacancy rate continues to decrease due to almost zero new completions volume –

CBRE, global real estate advisor, summarizes H1 2017 results of the Moscow Office market.

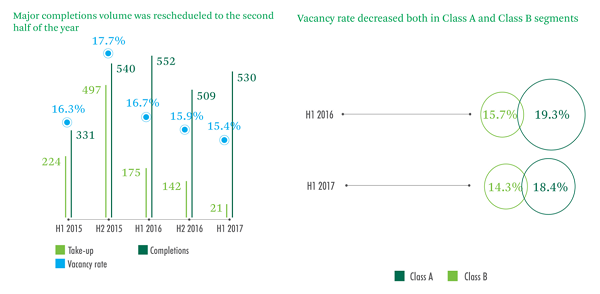

H1 2017 have experienced 530,400 sq m new leased and purchased for end-using purposes premises with just 4% lower compared to H1 2016. However, in H1 2016 take-up structure by 50% have been formed by sale transactions that were mostly non-market, while H1 2017 have experienced leasing transactions predominance (94%).

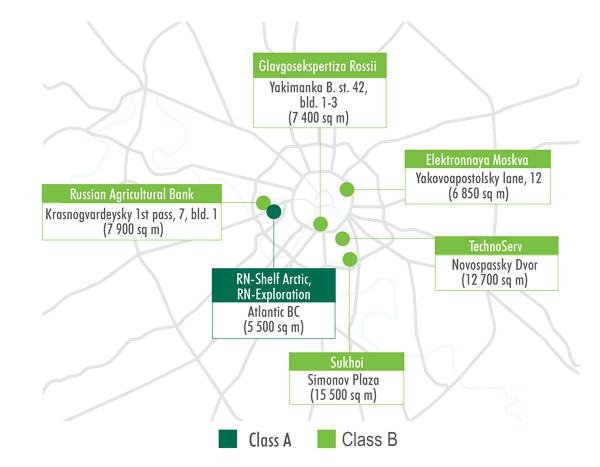

Largest deals in H1 2017

Source: CBRE, H1 2017

21,100 sq m of new office premises have been delivered in H1 2017 in Moscow (BC Dubrovka Plaza and new buildings in Bolshevik business centre), which is absolutely the lowest for over a last decade.

Office vacancy rate remains the downwards trend reaching 15.4% by the end of Q2 2017 which is 0.5 ppts lower compared to the 2016 year end and 1.3 ppts lower compared to H1 2016. For the last year vacancy rate decrease has been recorded both in Class A and B office markets: from 19.3% to 18.4% in Class A and from 15.7% to 14.3% in Class B.

Key Moscow Office market indicators

Source: CBRE, H1 2017

Elena Denisova, Senior Director, Head of Offices CBRE in Russia said:

"Vacancy rate decrease due to low new delivery volume and stabilized demand both in Class A and B has become the key trend in H1 2017. Meanwhile the lack of new buildings is deteriorating the collapse gradually formed on the market in a 2-3 years perspective, that will seriously affect medium and large-scale business. Current demand is still limited, whilst companies’ activity follows the recovery trend if compared to the preceding year. This activity conversion into the transactions in H2 or its failure will determine potential rental rates growth."