научно-практический

журнал

Новости редакции

Дорогие читатели! Представляем вашему вниманию первый номер журнала «ЛОГИСТИКА» в 2025 г. Прежде всего хотим обратить внимание читателей на нашего нового партнера R1 Development – девелоперскую компанию, которая создает среду нового поколения и специализируется на строительстве индустриально-логистической, коммерческой и жилой недвижимости. Один из проектов R1 Development – сеть индустриальных парков «Дружба».

Дорогие читатели! Представляем вашему вниманию заключительный номер журнала «ЛОГИСТИКА» в 2024 г. Мы постарались сделать его насыщенным и интересным.

Дорогие читатели! Представляем вашему вниманию 11-й номер журнала «ЛОГИСТИКА», где вы найдете актуальные материалы и статьи.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

CBRE Group, Inc. reports strong financial results for second-quarter 2017

Los Angeles, CA – July 27, 2017 — CBRE Group, Inc. (NYSE:CBG) today reported very strong financial results for the second quarter ended June 30, 2017 and increased its expectations for adjusted earnings per share for full-year 2017 to a range of $2.53 to $2.63.

“CBRE posted another quarter of excellent performance, with adjusted earnings per share up 25%. Continuing strength in our regional services business – led this quarter by broad-based strength in Asia Pacific and EMEA as well as continued strong organic growth in our global occupier outsourcing and capital markets businesses – was augmented by strong gains in our development services business,” said Bob Sulentic, CBRE’s president and chief executive officer. “Further, our regional services businesses, together, achieved solid margin expansion with the help of strong cost control.”

“Our performance demonstrates that we are operating a diversified, well-balanced business. Our high- quality professionals and globally integrated capabilities, increasingly enabled by technology and data, are helping us to produce superior client outcomes,” he continued. “Our prudent financial management has allowed us to improve profitability while continuing to make investments to further strengthen our position.”

Second-Quarter 2017 Results

- Revenue for the second quarter totaled $3.3 billion, an increase of 4% (7% local currency1). Fee revenue2 increased 3% (6% local currency) to $2.2 billion.

- On a GAAP basis, net income increased 62% and earnings per diluted share increased 61% to $197.2 million and $0.58 per share, respectively. Adjusted net income3 for the second quarter of 2017 rose 27% to $222.3 million, while adjusted earnings per share3 improved 25% to $0.65 per share.

- The adjustments to GAAP net income for the second quarter of 2017 included $27.3 million (pretax) of non-cash acquisition-related amortization and $15.4 million (pre-tax) of integration costs associated with the Global Workplace Solutions acquisition. These costs were partially offset by a $2.8 million (pre-tax) reversal of carried interest incentive compensation and a net tax benefit of $14.8 million associated with the aforementioned adjustments. The second quarter of 2017 is the final period in which there are adjustments for integration costs related to the Global Workplace Solutions acquisition.

- EBITDA4 increased 29% (31% local currency) to $399.9 million and adjusted EBITDA4 increased 14% (16% local currency) to $412.5 million. Adjusted EBITDA margin on fee revenue increased 182 basis points to 18.8%. The company’s regional services businesses – the Americas, Europe, the Middle East and Africa (EMEA) and Asia Pacific (APAC) – produced combined adjusted EBITDA growth for the quarter of 8% (10% local currency), or 12% excluding the impact of all currency movement including hedging activity.

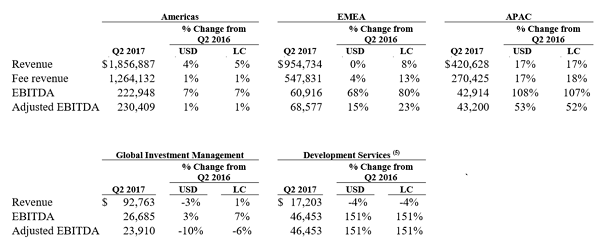

Second-Quarter 2017 Segment Review The following tables present highlights of CBRE segment performance during the second quarter of 2017 (dollars in thousands):

Excluding the impact of all currency movement including hedging activity, adjusted EBITDA growth rates for the second quarter of 2017 were: 3% in the Americas, 30% in EMEA, 44% in APAC and 0% in Global Investment Management.

Regionally, CBRE’s performance in the second quarter was led by APAC and EMEA.

- APAC posted a 17% (same local currency) revenue rise, with very strong growth in Australia, India, Japan and Singapore.

- EMEA revenue rose 8% in local currency, but was flat when converted to U.S. dollars due primarily to the depreciation of the British pound sterling. The region’s performance was paced by gains in the Netherlands, Spain and the United Kingdom, where CBRE’s activity levels continue to rebound strongly from the impact of last year’s Brexit vote.

- In the Americas, revenue increased 4% (5% local currency), with notable growth in occupier outsourcing and commercial mortgage services, which offset a relatively flat performance in property sales and a decline in leasing.

Revenue growth across CBRE’s global business lines was almost entirely organic.

- Global occupier outsourcing revenue rose 5% (9% local currency), while fee revenue increased 5% (10% local currency), all of which was organic growth.

o The Americas and APAC set the pace for growth with strong gains in Canada, India, Mexico, Singapore and the United States.

o The company continued to maintain a highly active new business pipeline with 103 total contracts signed during the second quarter, including 44 client expansions.

- The capital markets businesses – property sales and commercial mortgage services – produced double-digit growth with global revenue up 10% (12% local currency) on a combined basis.

- Property sales revenue rose 11% (13% local currency). This performance was paced by robust growth in APAC, which increased 45% (same local currency), and EMEA, which increased 32% (42% local currency).

o APAC saw strong growth across the region, especially in Greater China, Japan and Singapore.

o EMEA’s growth was led by the United Kingdom, where sales revenue surged 69%, as well as a broad range of countries, including France, Germany, Italy and the Netherlands. o Americas sales revenue edged down 2% (1% local currency), due primarily to a decrease in Canada. U.S. revenue was up slightly compared with an 8% decrease in the broader investment market, according to preliminary estimates from Real Capital Analytics.

- Commercial mortgage services revenue rose 10% (same local currency). o CBRE’s loan servicing portfolio totaled approximately $155 billion, up 16% from the yearearlier second quarter. o CBRE had strong loan origination activity with life insurance companies, Wall Street conduits and Government Sponsored Enterprises.

- Leasing revenue slipped 2% (1% local currency), as continued strength in APAC and EMEA was offset by weakness in the Americas. o APAC lease revenue rose 10% (same local currency), buoyed by Australia, India and Japan.

o In EMEA, Belgium, Spain and the United Kingdom led the way to 6% (12% local currency) growth for the region.

o Americas lease revenue declined 6% (same in local currency).

- Property management and valuation achieved solid growth.

o Revenue from property management services rose 5% (7% local currency), while fee revenue increased 2% (4% local currency).

o Valuation revenue increased 4% (7% local currency).

- In the Global Investment Management segment, assets under management (AUM) totaled $91.7 billion, up $3.1 billion from the second quarter of 2016. In local currency, AUM increased by $2.6 billion.

- In the Development Services segment, projects in process totaled $5.9 billion, down $1.2 billion from the second quarter of 2016, while the pipeline rose to $5.9 billion, up $2.9 billion in the same period. Fee-only projects constitute half of the pipeline.

Six-Month 2017 Results

- Revenue for the six months ended June 30, 2017 totaled $6.3 billion, an increase of 4% (7% local currency). Fee revenue increased 4% (6% local currency) to $4.1 billion. This growth was almost entirely organic.

- On a GAAP basis, net income and earnings per diluted share both increased 60% to $326.8 million and $0.96 per share, respectively. Adjusted net income for the first six months of 2017 rose 24% to $367.2 million, while adjusted earnings per share improved 23% to $1.08 per share.

- The adjustments to GAAP net income for the first six months of 2017 included $54.3 million (pretax) of non-cash acquisition-related amortization and $27.4 million (pre-tax) of integration costs associated with the Global Workplace Solutions acquisition. These costs were partially offset by an $18.0 million (pre-tax) reversal of carried interest incentive compensation and a net tax benefit of $23.2 million associated with the aforementioned adjustments.

- EBITDA increased 26% (27% local currency) to $706.4 million and adjusted EBITDA increased 11% (13% local currency) to $715.8 million. Adjusted EBITDA margin on fee revenue increased 115 basis points to 17.4%.

Business Outlook

“Our people around the world turned in an outstanding performance in the first half of 2017,” Mr. Sulentic said. “We enter the second half of 2017 with a stable global economy and solid fundamentals in most commercial real estate markets.”

CBRE has increased its outlook for 2017 adjusted earnings per share to a range of $2.53 to $2.63. At the mid-point of the range, this implies 12% growth in adjusted earnings per share for full-year 2017. Compared to its prior guidance given in February, the company expects its leasing revenue to be slightly below and its capital markets revenue to be slightly above its initial expectations for the year. The company expects fee revenue growth for its occupier outsourcing business to be 10% or slightly higher. The company expects adjusted EBITDA contributions from its development services and investment management businesses, together, to be flat to slightly up in 2017 versus its prior expectation of flat to slightly down. Finally, full-year margins are now likely to be at the high-end of the previously guided 17.5% to 18.0% range, despite a continued shift in business mix.

CBRE’s outlook for adjusted EBITDA in the second half of 2017 is little changed from its expectations at the beginning of the year. The expected benefit from a lower tax rate will be somewhat offset by growth in depreciation and amortization. The company expects positive earnings growth in the second half from its regional services businesses and its combined investment management and development services businesses.

Conference Call Details

The company’s second-quarter earnings conference call will be held today (Thursday, July 27, 2017) at 8:30 a.m. Eastern Time. A webcast, along with an associated slide presentation, will be accessible through the Investor Relations section of the company’s website.

The direct dial-in number for the conference call is 877-407-8037 for U.S. callers and 201-689-8037 for international callers. A replay of the call will be available starting at 1:00 p.m. Eastern Time on July 27, 2017, and ending at midnight Eastern Time on August 3, 2017. The dial-in number for the replay is 877-660-6853 for U.S. callers and 201-612-7415 for international callers. The access code for the replay is 13663913. A transcript of the call will be available on the company’s Investor Relations website.