Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

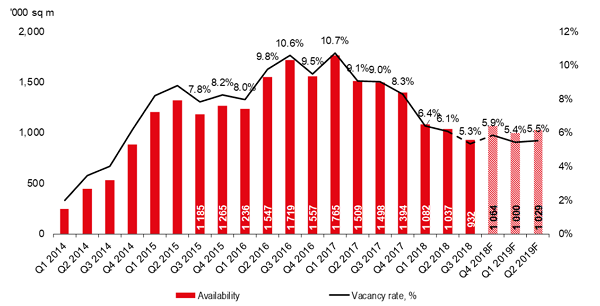

Vacancy in Moscow region warehouses dropped to a record low since 2014

The volume of vacant space fell below 1 million square metres for the first time in four years

According to JLL, in Q3 2018 the volume of vacant warehouse space on the Moscow region market declined to 932,000 sq m, or 5.3% of the total modern warehouse stock. The decline in Q3 was 0.7 ppt, or 105,000 sq m.

“This is the lowest level in the last four years. The vacancy rate on the Moscow region warehouse market has been increasing from early 2014 until 2017. Lately, we have seen a steady decline of this indicator. According to our estimates the vacancy rate will increase to 5.8% at the end of 2018 due to sizeable speculative completions. We expect it to stay at 5-6% in 2019.” – comments Oksana Kopylova, Head of Retail and Warehouse Research, JLL.

Vacant space on the Moscow region warehouse market

Источник: JLL

Some 355,000 sq m of warehouse space were completed in Q3 2018, bringing total warehouse completions in 9M 2018 to 570,000 sq m, 2.5 times higher than in the same period of last year.

Two large projects entered the market in Q3 2018: a distribution center for the e-commerce retailer Utkonos in the Orientir Sever 3 warehouse complex (68,000 sq m) and the new building for the logistic company Operator Kommercheskoy Nedvizhmosti in PNK Valischevo Industrial Park (52,000 sq m).

Additional 656,000 sq m of new warehouse premises are scheduled for delivery until the year end. Among significant projects expected in Q4 2018 are large distributional centres for federal retailers: Auchan DС in South Gate Industrial Park, IKEA DC in Solnechnogorsk District, the second phase of Wildberries DC in the Koledino industrial park and a distribution centre for Detsky Mir in PNK Park Bekasovo.

If the announced projects delivered on time, the 2018 completions will amount to 1.3m sq m vs 0.5m sq m in 2017. Notably, 61% of 2018 warehouses deliveries will be the built-to-suit schemes vs only 33% last year.

“Such a high share of contracted space is explained by the fact that large retailers are the main warehouse occupiers. Offline and online operators have accounted for 52% of the take-up this year. Each of them has specific requirements of the warehouse size and quality, and the built-to-suit format satisfies their needs most efficiently.” – says Evgeniy Bumagin, Head of Industrial & Warehouse Department, JLL, Russia & CIS. – “This trend is confirmed by our deal of the largest (140,000 sq m) automated distribution centre construction for the DIY-retailer Leroy Merlin. The new multifunctional logistic complex Beliy Rast will be built by PNK Group in the north of Moscow region.”

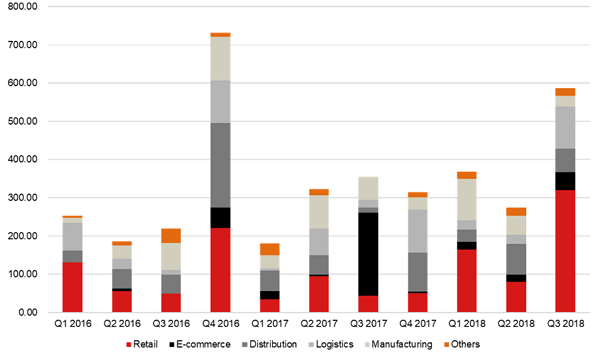

Moscow region warehouse demand distribution by business sector

Source: JLL

The warehouse take-up in Moscow region amounted to 1.2m sq m in 9M 2018, 48% above the level of Q1-Q3 2017. The take-up volume in Q3 2018 totaled 587,000 sq m, growing twice YoY double the volume in the previous quarter and 62% higher YoY. The annual take-up may exceed 1.5m sq m, 31% above the 2017 level.

“The rental rates for new deals on the Moscow region warehouse market are stable, in the range of RUB3,400–3,600 per sq m per year (excluding VAT and operating expenses). Nevertheless, the growth trend is resurfacing: weighted average asking rental rates for some projects increased to RUB3,800 per sq m per year. However, we do not expect a sharp growth of rental rates in the near future, as about 1m sq m of vacant premises, a result of new speculative construction, will continue to pressure rental rates”, – adds Evgeniy Bumagin.