Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

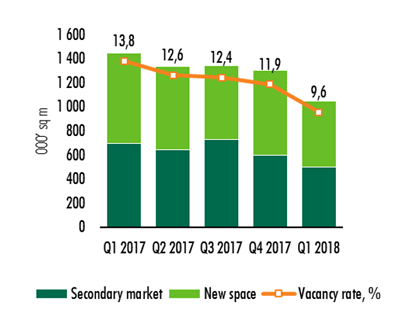

- Vacancy rate decreased to 9.6% of total stock in Moscow Region Industrial Big Box Market in Q1 2018 -

Moscow, 27 April 2018, - CBRE, global real estate advisor, summarizes Q1 2018 results of the Moscow Region Industrial Big Box Market. Total vacant space in Q1 amounted to 1.05 mn sq m, representing a 20% decrease from the end of 2017. Vacancy rate fell to 9.6% of total stock.

A significant increase in net absorption is observed in Q1 2018, driven by occupying premises previously leased on forward agreements and currently available warehouses.

Vacant space changes and structure, %, ‘000 sq m

Source: CBRE, Q1 2018

402,000 sq m was taken-up in Q1 2018, representing a 2.2 times growth YoY.

Demand is mainly driven by companies expanding their warehouse spaces rather than optimizing the logistics.

Largest lease deals in I&L segment in Q1 2018

|

Tenant |

Area, sq m |

Sector |

Property |

Landlord |

|

Vkusvill |

51,000 |

Retail |

PNK Severnoye Sheremetievo |

PNK Group |

|

Rockwool |

26,000 |

Manufacture |

Noginsk Logistic Park |

Raven Russia |

|

Auchan |

21,000 |

Retail |

South Gate Industrial Park |

Radius Group |

Source: CBRE, Q1 2018

According to CBRE report, total take-up will reach 1.1-1.3 mn sq m in 2018.

Based on the leasing activity and absorption dynamics, vacant space is expected to decrease to 9.2 of total stock by the end of 2018.

Key Moscow I&L market indicators

|

2016 |

2017 |

2018 F |

|

|

Total supply (end of the year), class A, mn sq m |

10.3 |

11.0 |

11.7 |

|

New delivery, mn sq m |

0.87 |

0.62 |

0.69 |

|

Take-up, mn sq m |

1.01 |

1.09 |

1.1-1.3 |

|

Weighted average rental rate*, RUB/sq m /year |

3,300 |

3,400 |

3,500 |

|

Vacancy* , % |

12.8 |

11.9 |

9.2 |

Source: CBRE, Q1 2018

Anton Alyabyev, Director of Warehouse & Industrial Department, CBRE in Russia said:

"We observed a number of positive changes on the market in the beginning of 2018. Both local and international companies were active on the warehouse market, several large transactions were closed in Q1. There are qualitative changes in demand for warehouse – we observe growing interest to projects customized for specific logistics cases and location. That’s why general contract and BTS solutions are in demand.”

Anastasia Chernoyarova, Analyst of Research Department, CBRE in Russia said:

"We observe the lowest vacancy level on the market since 2015. Decrease in vacant space is attributable to strong take-up dynamics. The market is becoming more balanced and we observe prerequisites for growth in commercial conditions.”