Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Tenants return to Garden Ring, following the summer reconstruction

In H2 2017, the vacancy rate there declined to 11.7%, down by 1.2ppt

JLL analysts estimated the vacancy rate in the main Moscow high streets at 9.0% in Q4 2017, 0.6ppt below the level a year earlier. Petrovka Street and the Garden Ring were the leaders in improving occupancy in H2 2017, with vacancies declining by 4.3ppt and 1.2ppt, respectively.

The end of the Garden Ring reconstruction as a part of My Street programme was one of the most significant events in 2017. The summer renovation of the northern section (from Mayakovskaya metro station to Yauza River) and the southern section (from Yauza River to Park Kultury metro station) of the Garden Ring contributed to the vacancy rates dropping in H2 2017 from 23.1% to 20.1%, and from 10.3% to 8.8%, respectively. For comparison, the vacancy indicator in the part of the Garden Ring renovated in 2016 changed insignificantly and amounted to 9.6%. As a result, the overall vacancy rate on the Garden Ring declined from 12.9% to 11.7% in H2 2017.

Vacancy rate in the main Moscow high streets

Source: JLL

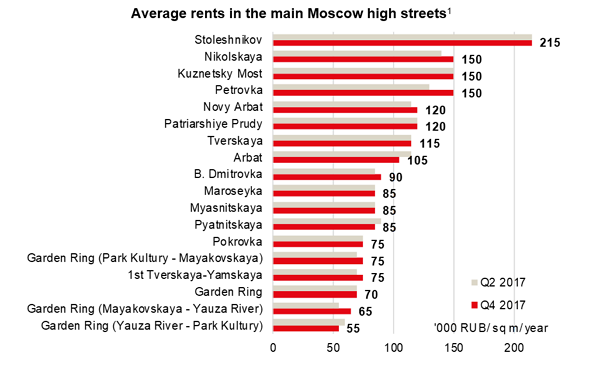

“After the street reconstruction has been completed, the access to many premises has improved, making them again attractive for retailers. Rental growth in the northern section of the Garden Ring, which has been renovated this summer, confirms a return of tenant demand. The rents there have increased by 18% in H2 2017 to 65,000 RUB/sq m/year. The northern section is now the second most expensive part of the Garden Ring by the level of rents, while the vacancy rate there is still the highest. Nevertheless, we expect the ongoing decline of the vacancy rate to continue,” – comments Yulia Nazarova, Head of Street Retail in Moscow, JLL, Russia & CIS.

Average rents in the main Moscow high streets

Source: JLL

“The top-3 most occupied streets at the end of the year are Pokrovka (2.9% of vacant premises), Myasnitskaya (3.4%) and Patriarshiye Prudy District (3.5%). The list of the most expensive streets includes Stoleshnikov Lane, Nikolskaya Street, Kuznetsky Most Street, and Petrovka Street. The high-level rental rates in these locations confirm a strong tenant demand. As a result, rental rates have risen in Q4 2017 on Petrovka Street, and in Q3 2017 on Nikolskaya Street.” – notes Oksana Kopylova, Head of Retail and Warehouse Research, JLL, Russia & CIS.

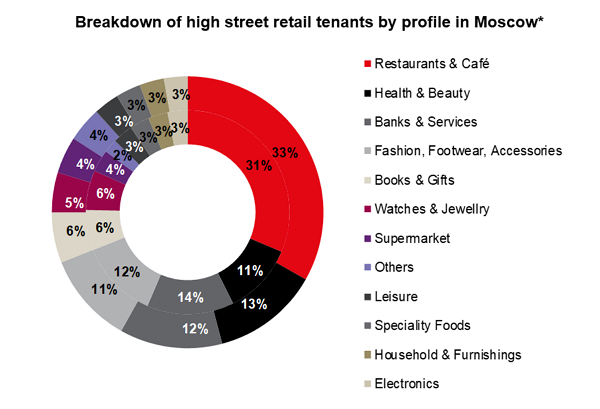

On the demand side, restaurants & cafés remained the leaders in the central retail corridors. They accounted for 41% of all 2017 leasing inquiries during the year. Supermarkets and grocery stores were the second most active at 13%, fashion operators were the third (12%), followed by health & beauty operators (11%).

Foodservice operators also increased their Moscow high street presence more than other categories last year, accounting now for 33% of the market. New premises were opened by such brands as BB & Burgers (with new outlets on Myasnitskaya, 1st Tverskaya-Yamskaya, and Maroseyka streets), Burger Heroes (Kamergersky Lane and Garden Ring), Israel coffee chain Cofix (Tverskaya and Pyatnitskaya), and two St. Petersburg restaurant chains, Ketch Up Burger and Marcellis, opening their first outlets in Moscow.

Health & beauty operators increased their presence on central streets as well, raising their share by 2ppt, to 13%. Banks & services and fashion operators decreased the number of outlets. The latter dropped out of the top-3 list and was replaced by health & beauty.

Breakdown of high street retail tenants by profile in Moscow*

*Inner circle – 2016 year, exterior circle – 2017 year.

Source: JLL

Rotation on the Moscow retail corridors declined to 8% in Q4 2017 from a 9% in Q3 2017. The active occupancy of premises which had not been accessible during reconstruction works on the Garden Ring continued in the last three months of 2017. Rotation on the renovated northern section reached 16%, while the average Garden Ring level was estimated at 8%.