Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Shopping centres outperformed offices in Russia real estate investments

JLL presents Q1 2017 investment market results

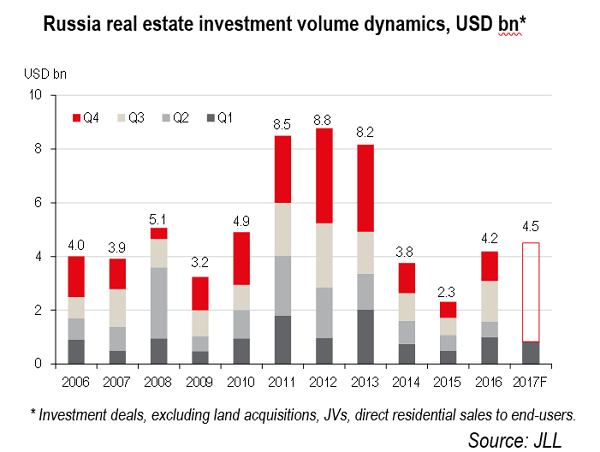

In Q1 2017, Russia’s real estate investments reached USD830m, down 18% YoY, according to JLL calculations. Despite the decline, investment activity is improving, with a higher number of deals and a more even breakdown across sectors and regions.

Vladimir Pantyushin, Head of Research, JLL, Russia & CIS, comments: “Stable exchange rate together with the economy climbing out of recession supported the rise of investments. Rental market stabilization across all segments became the key factor stimulating investor interest in real estate assets. Moreover, the volume of deals at the negotiations stage and under due diligence shows a sizeable pipeline of future transactions and further improvement of the investment market.”

JLL analysts expect investments to grow in the near future. According to their forecast for 2017, investment volume will reach USD4.5bn vs USD4.2bn in 2016.

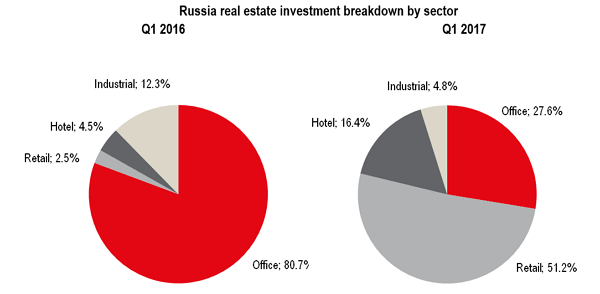

In Q1 2017, the retail sector attracted the bulk of investments, with the purchase of the Leto SEC in St. Petersburg by MallTech as the main transaction. The share of retail investments exceeded 50% of the total volume, outperforming offices, a traditional leader.

“Retail market stabilization led to rising shopping centre occupancy and improved their financial performance. Market players adjusted to the current conditions. This stimulates owners and investors to come to common terms on asset values, with a number of deals reaching advanced stages and likely to be completed in the near terms. Although Russian investors continued to dominate in Q1 2017, we expect foreign investor activity to rebound after hitting the historical low of 3.5% last year.” – Evgeniy Semenov, Regional Director, Head of Capital Markets, JLL, Russia & CIS, notes.

Source: JLL

The distribution of investment activity across regions became more even. The share of Moscow deals declined to 50% from 81% in Q1 2016. The highest investment growth was observed in St. Petersburg, which share increasing from 9% to 20% due to the several large transactions. In absolute terms, the St. Petersburg investment volume doubled.

Prime yields remain unchanged from the previous quarter. As benchmarks for the market players, JLL analysts take Moscow prime yields between 9.0-10.5% for offices and shopping centres and 11.0-12.5% for warehouses; St. Petersburg prime yields at 9.5-11.5% for offices and shopping centres and 11.5-13.5% for warehouses.