Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Sharp vacancy drop on the Moscow region warehouse market

In Q1 2018 the vacancy rate declined to the lowest level since the beginning of 2015

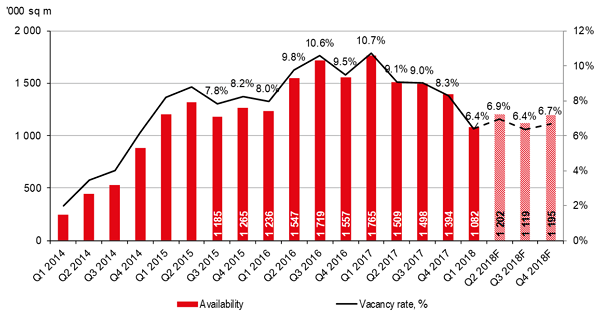

According to JLL, in Q1 2018 the vacancy rate on the Moscow region warehouse market declined by 1.9 ppt, from 8.3% to 6.4%. In absolute terms, the volume of vacant spaces shrank to 1.08m sq m. This marked the lowest vacancy levels since 2015, both relative and absolute.

“The significant decline of the vacancy rate in Q1 2018 was facilitated by high activity on the secondary market. During the first three months of the year more than 500,000 sq m of warehouse space changed the status from vacant to occupied and vice versa. A significant surplus of occupied space over the released areas reduced of the vacancy rate.” – said Oksana Kopylova, Head of Retail and Warehouse Research, JLL, Russia & CIS. – “This extended the trend of declining vacant space since the beginning of 2017.”

Available space dynamics on the Moscow region warehouse market

Source: JLL

The main reason for the vacancy drop was low completions. Warehouse completions in Q1 2018 were 68,000 sq m, of which 46,000 sq m in PNK Park Valisсhevo.

By the end of 2018, some 879,000 sq m of warehouse premises are announced for delivery. The main 2018 warehouses projects are built-to-suit schemes for retailers, namely a warehouse complex for Wildberries.ru (146,000 sq m), 90,000 sq m in Solnechnogorsk District for a large international retailer, 68,000 sq m in the new Orientir Sever 3 for Utkonos, and 52,000 sq m in PNK Park Valisсhevo for the logistic company Commercial Real Estate Operator.

“More than half of projects under construction (487,000 sq m) are speculative and non-occupied. Their delivery will lead to a vacancy rate increase. However, high warehouse market activity will later contribute to its absorption. By the end of the year we expect the stabilization of the vacancy rate in the range of 6-7%”, – commented Oksana Kopylova.

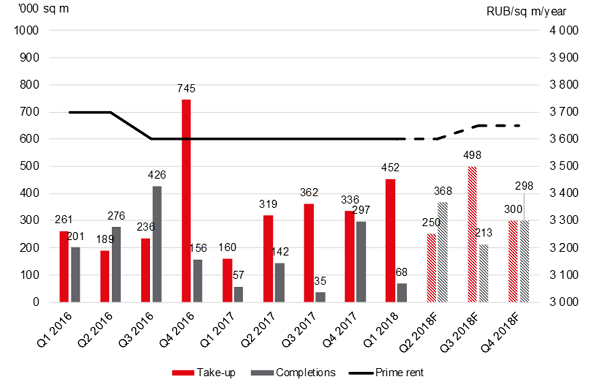

Take-up, completions and prime rent dynamics on the Moscow region warehouse market

Source: JLL

Warehouse demand remains high. The take-up volume in Q1 2018 totaled 452,000 sq m, three times higher YoY. Some 71% of the deals were competed in existing facilities, the rest were contracts in under-construction buildings.

“Although historically the beginning of the year had usually been quiet, the results of Q1 2018 set a record and were comparable to the results of the whole Н1 2017,” – commented Evgeniy Bumagin, National Director, Industrial & Warehouses Department, JLL, Russia & CIS. – “High business activity (take-up above 300,000 sq m) continues since Q2 2017, supported by stable and attractive rental levels.”

Weighted average asking rental rates in new transactions on the Moscow region warehouse market are at a minimum in the range of RUB3,300-3,600 per the sq m per year (excluding VAT and operating expenses). Actual rents depend on a specific location and proximity to MKAD.

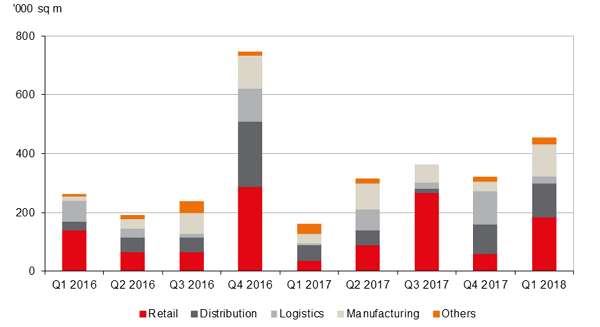

The largest deals in Q1 2018 were the following: VkusVill leased 52,000 sq m in PNK Park Severnoye Sheremetyevo; retailer Maksidom bought 41,000 sq m in the Nidan Soki complex; DNS expanded in Atlant Park (39,000 sq m); A Plus Development built a new 21,600 sq m built-to-suit project for the AGC Glass manufacturing company in Klin. Retailers were the main demand drivers in Q1 2018, accounting for 40% of all deals.

Demand distribution by business sector in Moscow region

Source: JLL

If the current level of activity is maintained, the take-up volume on the Moscow region warehouse market this year can reach 1.5m sq m. “Currently there is a number of active large requests, more than 30,000 sq m each, coming from companies representing different business sectors. Against the background of these positive market momentum, only geopolitical situation can cause fears that can correct the development plans of some companies, and in some cases put them on hold,” – commented Evgeniy Bumagin.