Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

In Q3, investors took a break before the end of the year

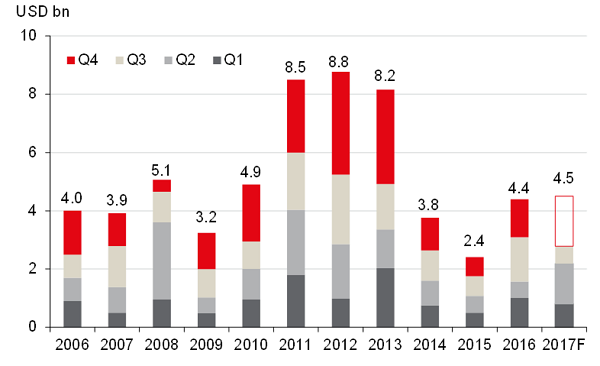

MOSCOW, September 28, 2017 – In Q1-Q3 2017, Russia’s real estate investments declined by 13% vs. Q1-Q3 2016 and reached USD2.7bn, according to JLL calculations. A Q3 2017 slowdown has driven the total volume decline over three quarters, three times down YoY to USD500m.

Olesya Dzuba, Head of Research, JLL, Russia & CIS, comments: “The last three months produced a mixed outcome. The economy continued to gain the momentum, and the rouble has recovered earlier losses. However, two major banks were effectively nationalized, raising concerns about the banking sector. We expect the stabilization of investor activity by the end of the year. According to our forecast for 2017, the investment volume will reach USD4.5bn.”

Russia real estate investment deals volume dynamics, USD bn*

* Investment deals, excluding land acquisitions, JVs, direct residential sales to end-users.

Source: JLL

In 9M 2017, the retail sector accounted for 37% of the total volume, on the back of several large investments in H1 2017. Offices followed, with 31% of all deals.

The share of foreign investments increased from 5% in 2016 to 19% in Q1-Q3 2017.

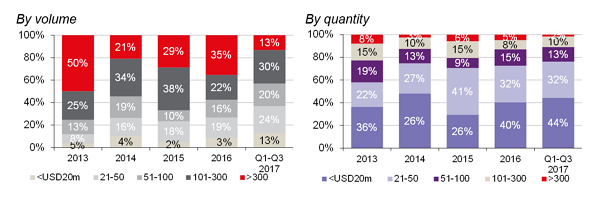

The bulk of Q3 deals were transactions under USD50m. However, a number of portfolio and large asset deals are expected to reach advanced stages by the end of the year.

“Russian real estate assets continued to attract investors during Q3, although the focus recently was on small assets. In Q3 2017, the average deal size declined to USD30m from USD100m a year ago. However, the share of debt restructuring transactions fell to 14% from 53% in Q3 2016. We also note a strong investor interest in regional assets.” – Evgeniy Semenov, Regional Director, Head of Capital Markets, JLL, Russia & CIS, notes.

Russia real estate investment breakdown by size

By volume By quantity

Source: JLL

In Q1-Q3 2017, the main activity was concentrated in Moscow, with 71% of all deals closed there, although this share declined from 88% in Q1-Q3 2016. Higher investment activity was recorded in St. Petersburg, which share had increased from 6% in 9M 2016 to 22% in 9M 2017. In absolute terms, the St. Petersburg investment volume increased 3.5 times, from USD156m to USD578m.

Prime yields remained flat. As benchmarks for the market players, JLL analysts consider Moscow prime yields between 9.0-10.5% for offices and shopping centres and 11.0-12.5% for warehouses; St. Petersburg prime yields at 9.5-11.5% for offices and shopping centres and 11.5-13.5% for warehouses. Following key rate cuts by the Central Bank, the cost of bank financing will continue declining and will likely lead to yield compression.