Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

Foreign investor activity increases in the Russian market, says JLL

In Q2 2017, Russia’s real estate investments more than doubled vs Q2 2016 and reached USD1.4bn, according to JLL calculations. This brought the H1 2017 volume to USD2.2bn, 39% up from H1 2016 (USD1.6bn).

Olesya Dzuba, Head of Research, JLL, Russia & CIS, comments: “Rouble is trading in a range of 56-61 per US dollar and displays lower volatility compared to H1 2016. Along with currency stability and the recovery of the Russian economy, investor activity on the real estate market also improves. Several deals from 2016 were closed in H1 2017, raising the overall number of completed transactions. We expect several other deals started in 2016 to be completed this year.”

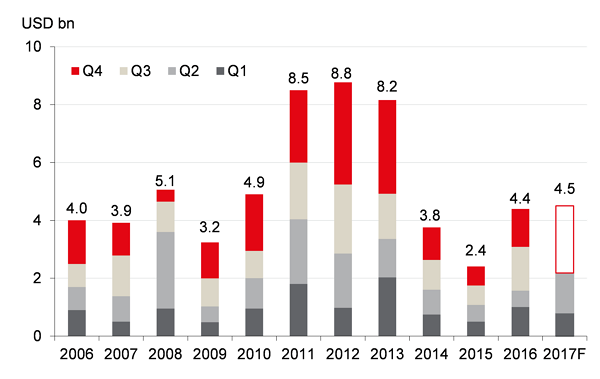

JLL analysts expect investments to continue growing in the near future. According to their forecast for 2017, investment volume will reach USD4.5bn.

Russia real estate investment volume dynamics, USD bn*

* Investment deals, excluding land acquisitions, JVs, direct residential sales to end-users.

Source: JLL

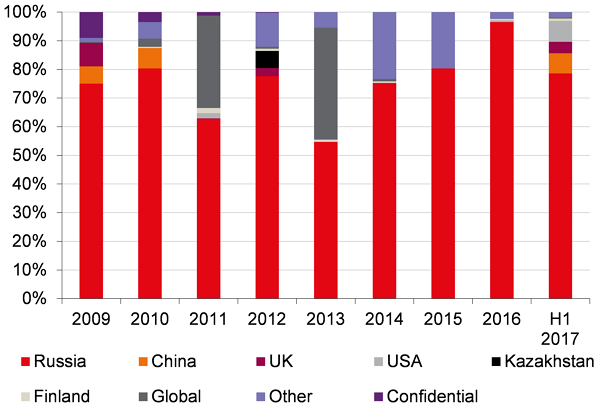

In H1 2017, retail transactions dominated, with 41% of the total volume. The office sector accounted for 32%. The sale of Vozdvizhenka Centre to Fosun Group and Avica Management Company became a major transaction of the year. The share of foreign investments increased from 6% in 2016 to 21% in H1 2017.

“Investment activity continues to recover along with the rental market stabilization. There is a noticeable improvement in the presence of foreign investors. Western, Asian and Middle Eastern companies are interested in quality Russian assets. Fosun Group became the first Chinese investor into Russian real estate assets since 2010. We also expect a number of deals with foreign players to reach advanced stages by the end of the year.” – Evgeniy Semenov, Regional Director, Head of Capital Markets, JLL, Russia & CIS, notes.

Russia real estate investment breakdown by source of capital

Source: JLL

In H1 2017, the main activity was concentrated in Moscow, with 73% of all deals closed there, although its share declined from 82% in H1 2016. At the same time, the growth of investments was recorded in St. Petersburg, the share of which increased from 6% in H1 2016 to 18% in H1 2017 due to several large transactions (sales of Leto SEC and of EPI Russia I Ky portfolio). In absolute terms, the St. Petersburg investment volume increased four times to USD393m in H1 2017 from USD96m in H1 2016.

Prime yields remain flat. As benchmarks for the market players, JLL analysts consider Moscow prime yields between 9.0-10.5% for offices and shopping centres and 11.0-12.5% for warehouses; St. Petersburg prime yields at 9.5-11.5% for offices and shopping centres and 11.5-13.5% for warehouses. On the back of recent key rate cuts by the Central Bank of Russia, the cost of bank financing will continue declining and will likely lead to yield compression.