Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

More than half of F&B 2018 openings in the centre of Moscow were represented by new restaurant and cafe concepts

The significant part of them were launched by restaurant holdings

According to JLL, restaurants and cafes on the main Moscow high streets in 2018 were the most active: new foodservice units accounted for 40% of annual openings, the share of closed units amounted to 37%. However, in absolute terms the number of F&B openings were 2.5 times greater than closings.

More than half (55%) of restaurants and cafes opened on the main Moscow streets were newcomers. In addition, 77% of new restaurant concepts were launched by established restaurant groups.

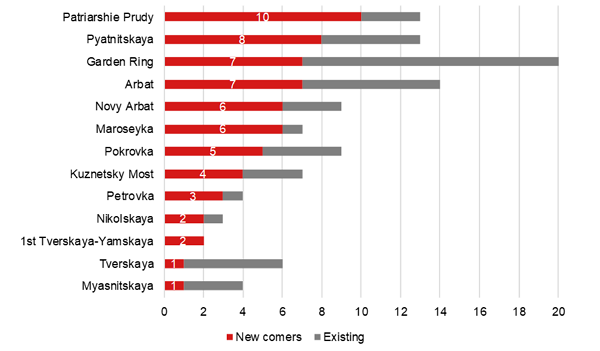

Most newcomers started in the traditional restaurant locations: 16% opened in the Patriarshie Prudy district[1], 13% of new concepts were launched on Pyatnitskaya Street. Arbat Street and Garden Ring were also supplemented with the new restaurant market players (11% in each locations).

Number of restaurants and cafes opened in Moscow in 2018, new and existing concepts

Source: JLL

Among the newcomers opened in the Patriarshie Prudy are Uilliam Lamberti`s Coco Lambert and Montifiori, and Avocado Queen, the project of Novikov Group. Prscco Bar and coffeeshop Break café were added to the tenant mix on Pyatnitskaya Street.

In contrast, among the restaurants closed in 2018 were Glida, Begemot Café and Berezka Bistrot in the Patriarshie Prudy district. Bar Klava relocated from the Patriarshie Prudy to Petrovka Street. The Garden Ring lost El Gaucho near Mayakovskaya metro station and Shesh-Besh near Smolenskaya Square, and the restaurant Yakor on the 1st Tverskaya-Yamskaya Street has been closed.

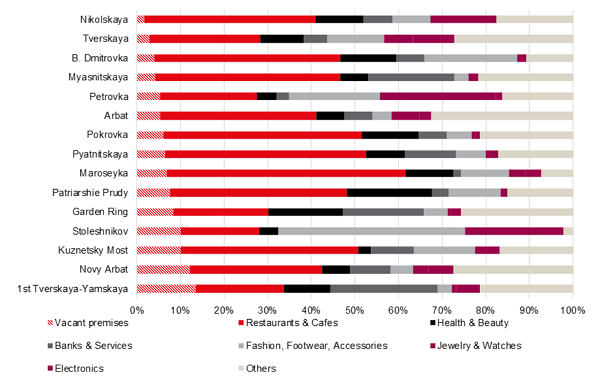

The increase of F&B share is the main trend in Moscow street retail over the past three years. As a result, the restaurants and cafes steadily lead the structure of existing operators. The share of this segment accounted for 45-60% on 5 of 15 reviewed streets by the end of 2018, while the average figure was 36%.

Fashion is the leading segment in the tenant mix structure by the volume of occupied premises in such locations as Stoleshnikov Lane and Petrovka Street (48% and 22% respectively), which are traditionally occupied by luxury brands.

Breakdown of Moscow street retail tenant mix by street

Source: JLL

“Luxury streets remain the most expensive Moscow high streets. As an example, despite a small correction of rental rate (-8% YoY), Stoleshnikov Lane is still the most expensive street with the average rate[2] of 205,000 RUB/sq m/year. Moreover, maximum rental rates of 150,000-200,000 RUB/sq m/year are observed in the most popular locations such as the part of Petrovka Street before intersection with Stoleshnikov Lane, the part of Kuznetskiy Most Street opposite to TSUM, and others. These locations remain the most demanded among retailers and are a priority for flagship stores opening. However, this demand is hard to meet due to the lack of suitable premises on the market, top locations are almost always occupied,” – comments Yulia Nazarova, Head of Street Retail in Moscow, JLL. – “In 2019 we expect high demand for particular locations on the street retail market along with overall stable rental rates from 65,000 to 165,000 RUB/sq m/year on average depending on the location.”

On the back of active opening of shopping units in the street retail, the vacancy rate has declined to a four-year minimum of 8.2% in Q4 2018, 0.8 ppt down since the end of 2017. The major decrease occurred on Tverskaya (5.1 ppt down to 3.2%), B. Dmitrovka (4.3 ppt down to 4.3%) and Nikolskaya (3.5 ppt down to 1.8%) streets, which are the locations with the lowest vacancy rates at the end of 2018.

[1] The central part of the Patriarshie Prudy area, between Yermolaevsky, Maly Patriarshiy & Spiridonyevskiy lanes, and Malaya Bronnaya Street.

[2] Rents are given for premises of 100-300 sq m with a separate entrance and a showcase on the first floor inside the Third Ring Road.