Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Kiev quality hotels market shows stable growth in occupancy fourth year in a row

Kiev

JLL presents the Q1 2017 Kiev quality hotels market results[1].

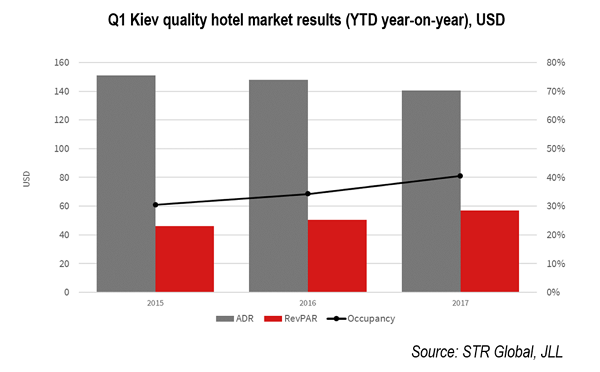

“Compared to what we forecasted for 2017 when reporting on 2016 results, quality hotels in the Ukrainian capital are meeting the expectations. The occupancy grew healthily in the first 3 months of the year, actually surpassing the YTD results of the last stable year, 2013 (39%). 40% of quality room stock was occupied in Jan-March this year, vs. 34 last year, and 31 in 2015.” – Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says.

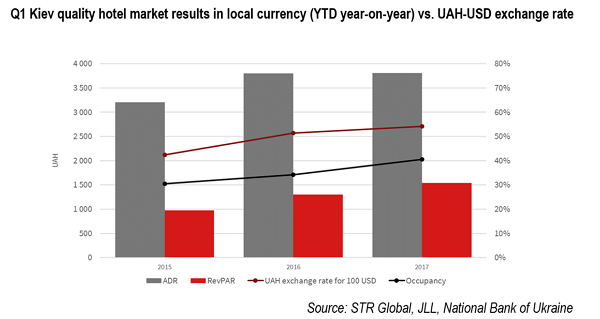

In terms of rates, average quarterly ADR results continue to give mixed feelings – still growing in UAH terms (probably a result of continued weakness of the national currency, rather than a real market condition change), and still falling in USD terms (to an absolute figure of USD141 vs. USD148 last year and USD151 in 2015). In local currency, quarterly average ADR remained relatively stable compared to a year before (grew by a meagre 7,5 hryvnia) but increased by over UAH 600 compared to 2015, reaching UAH 3,203.

RevPAR though, even USD-denominated, makes one see a recovery in underway. On the back of a stronger occupancy, the average index reached USD57 in the Q1 2017, the highest in the past 4 years (growth by 12.5% YoY). In local currency, obviously, the figure is even more impressive, UAH1,542 which is about 240 hryvnia (19%) higher than last year.

“We connect this growth with such factors like: 1) political situation has been stable for a while, and 2) business is slowly coming back having realized that this is new reality and there’s nothing else to gain by waiting. We now await the second quarter, historically the most active time of the year for the touristic and hotel market of the largest city in Ukraine, with higher occupancies and rates of the year, to see if this is a true trend for recovery.” – Tatiana Veller notes.