Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Investment into CEE on course for historic high in 2017

- Investment volume driven by retail investment –

- Russia is only starting to unveil its path to recovery -

Prague - Moscow

Investment into Central and Eastern European (CEE) commercial real estate is set to reach an all-time record high in 2017.

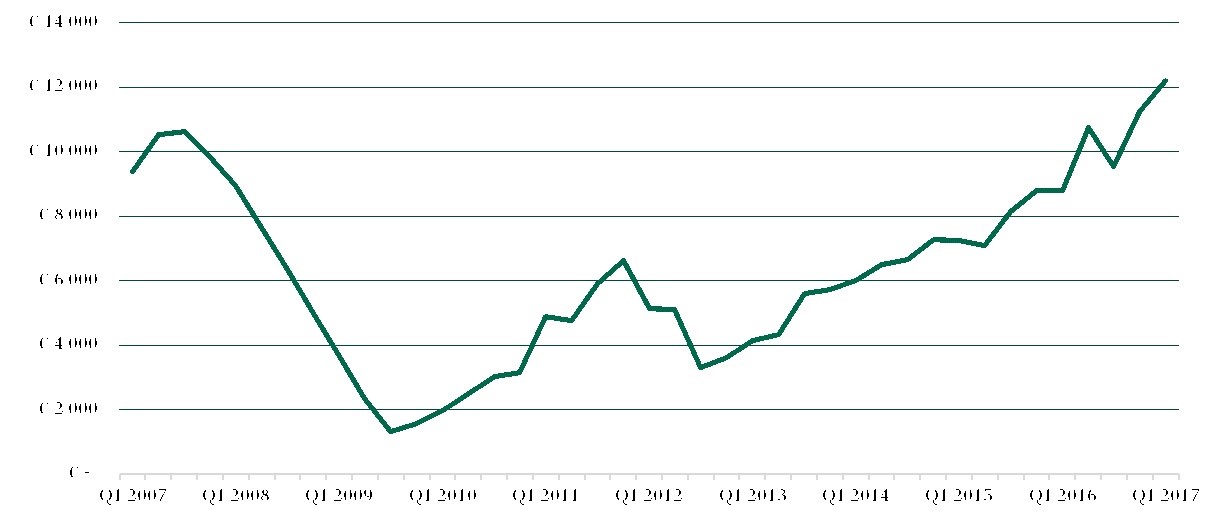

In the past 12 months, €12.2 bln was invested by investors into core-CEE markets, reaching a new peak for the four rolling quarters.

Core-CEE Investment volume (4 quarters rolling total)

Momentum is expected to continue in 2017 as investors perceive the CEE region as an investment market offering strong economic fundamentals and an attractive yield gap to Western European markets.

The full year 2017 is expected to exceed the record investment volume of €11.3 bln in 2016 with all core - CEE countries expected to perform strongly. The 2007 peak stood at €9.8 bln.

Anthony Selman, Head of CEE Investment Properties, commented:

“The unprecedented volume of capital targeting CEE is a testament to the strong economic fundamentals and growth of the region. As competition for prime assets heats up we expect investors to be more aggressive on secondary property in the core markets while taking another serious look at markets offering a greater yield advantage such as Hungary, Slovakia and Romania. Russia will also benefit as the economy stabilizes and risk is out of the currency.”

Core-CEE investment volume has been historically driven by the Czech Republic and Poland, which together account for app 75% of total volume on average. However, in the past two quarters the Czech Republic became the market with the highest investment volume in CEE. In Q1 2017, over EUR 1.4 bln was invested into commercial real estate in the Czech Republic accounting for more than half of total investment volume within the core-CEE markets.

As most uncertainty is now out of the Polish market core money is finding its way back and Poland is expected to have a strong second half of the year following a slow start.

Investors have found their way back to the Hungarian market in a big way with almost EUR 500mln transacted in Q1 2017. The full year of 2017 is expected to be the strongest year ever. Yields will continue to compress across sectors making it the market with the most significant yield movement.

The Slovak market is on the radar of investors looking for yield as competition for assets is becoming fiercer in the Czech Republic.

After two quarters of dominance of investment in the office sector, the most attractive asset type in Q1 2017 proved to be the retail sector accounting for almost €1.4 billion in total – with a multitude of prime assets trading. Retail is expected to be the most popular asset class for the full year of 2017.

So far in 2017, In the Czech Republic, prime yields have compressed for offices, shopping centres and high-street retail. In Hungary, prime yields dropped for offices and shopping centres. Further yield compression is expected in Hungary and Slovakia while prime yields remained stable in most other markets.

Irina Ushakova, Senior Director, Head of Capital Markets Department, CBRE in Russia, commented:

“Just like CEE countries Russia has demonstrated positive investment trends in the last couple of years. Given positive market activity in Russia, decrease in the key rate and active interest from investors, we expect that the total investment volume in 2017 will hit over $5 bln, demonstrating a 10% growth YOY. Whilst certain CEE countries have reached their record high investment volume, Russia is only starting to unveil its path to recovery.”