Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

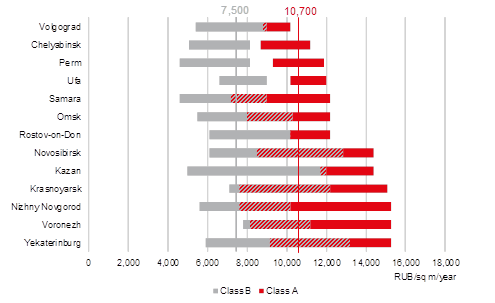

The most expensive offices in millionniki cities may cost more than RUB15,000 per sq m

MOSCOW, October 05, 2017 – According to JLL research, in the period from July 2016 to June 2017, 134,500 sq m of new office space has entered the Russia regional millionniki cities market (excluding Moscow and St. Petersburg), down 65% YoY.

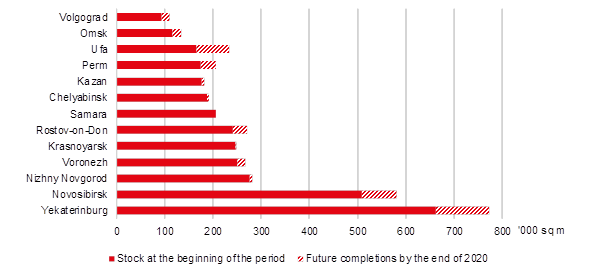

The total office stock of regional millionniki cities has reached 3.3 m sq m, corresponding to just 18% of the Moscow office supply. Some 137,000 sq m are expected for delivery by the end of 2017.

Yekaterinburg remains the leader in the regional market: its total office stock reached 663,000 sq m at the end of H1 2017, which accounts for 20% of the total regional office market supply. In the period from July 2016 to June 2017, 41,751 sq m of new office space have been completed there. The second largest market is Novosibirsk (508,000 sq m), the third one, significantly lagging behind the two leaders, is Nizhny Novgorod (276,000 sq m).

Quality office supply in Russia regional office market

Source: JLL

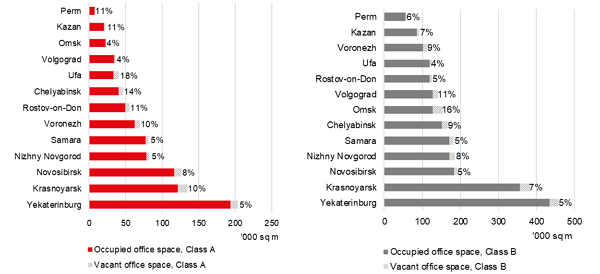

Within the regional millionniki cities, the average vacancy rate in Class A is 9%, in Class B 7% which is almost half of the vacancy rate in Moscow (16.7% and 15.6% accordingly).

Occupied and vacant offices

Class A Class B

Source: JLL

The lowest vacancy rate in Class A (about 4%) has been registered in the cities with the smallest quality office stock, Omsk and Volgograd. The Class B vacancy rate in these cities was the highest on the regional market, 11% in Volgograd and 16% in Omsk. The highest Class A vacancy rate, at 18%, was recorded in Ufa.

Asking rental rates on the regional market vary with quality and location. Operating expenses are typically included in the base rent. Average Class A rental rates are RUB10,700 per sq m per year, Class B – RUB7,500 per sq m per year excluding VAT. The highest level of Class A rent is in Yekaterinburg, Voronezh, and Nizhny Novgorod. The Class B rental rate in Yekaterinburg is the highest as well.

Office asking rental rates

Source: JLL

“About 385,400 sq m of new offices are expected to be commissioned шn regional millionniki cities by the end of 2020.” – says Alexander Bazhenov, Office Market Analyst, JLL. – “Moreover, the regional market contains many projects frozen at advanced construction stages, with the total rentable area of over 300,000 sq m. These projects may be added to the stock quickly and put pressure on the rental and vacancy rates.”