Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

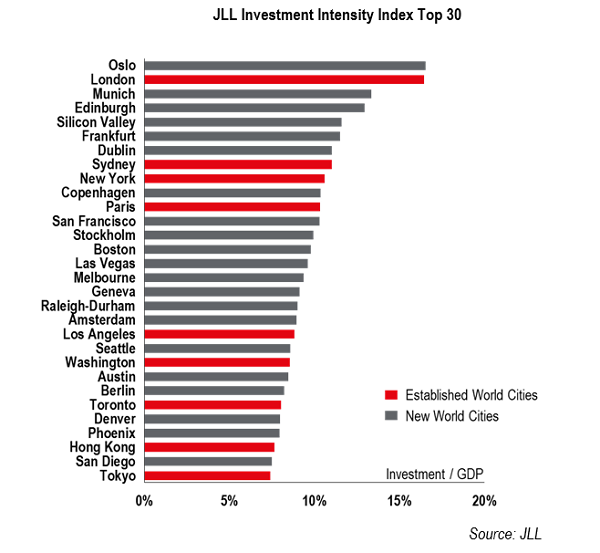

European cities attract the most real estate investment relative to their size, says JLL

CANNES

- Investment Intensity Index identifies 12 European cities in the top 30 globally for investment relative to a market’s economic size

- Oslo tops the global ranking, followed by London and Munich

Europe’s presence can be strongly felt in a ranking of markets which attract the most real estate investment compared to their relative economic size, with 12 of the top 30 located in the region, according to JLL’s Investment Intensity Index.

Oslo (1) tops the Index as a small but highly sought-after market thanks to active domestic investors. London, in second position globally, remains a favoured investment destination. Munich (3) and Edinburgh (4) round off the global top four.

European cities are seen as a safe-haven for investment dollars and continue to attract investor demand as they demonstrate high levels of transparency and sustainability together with robust technology, infrastructure and liveability credentials.

“Significant capital continues to target real estate, and Europe’s New World Cities – mid-sized markets which specialise in high-tech and high-value activities, such as Berlin and Stockholm – sit high on the wish lists of global investors,” says Jeremy Kelly, director in global research, JLL. “The attractiveness of these smaller markets in transparent economies is evident, with the contribution of New World Cities to global investment volumes rising from 12% in 2006 to 23% in 2016, overtaking the share of global investment into the ‘Big 6’ markets of New York, London, Paris, Tokyo, Hong Kong and Singapore.”

Elsewhere in the top 30, the Nordic cities feature strongly. After Oslo (1), neighbouring Scandinavian capitals Copenhagen (10) and Stockholm (13) also appear.

Other favoured New World Cities in Europe include Frankfurt (6), Dublin (7), Geneva (17), Amsterdam (19) and Berlin (24).

Of the global top 30, Europe and North America dominate. There are four cities from the Asia Pacific region, although the balance is starting to shift, as investors target its dynamic cities.

Moscow currently ranks 91st overall in the Investment Intensity Index. “While it is among the top 50 markets globally for total direct real estate investment volumes over the last three years, it is also the 6th largest urban economy in the world, which means there is substantial room for growth in order for investment volumes to match its economic importance.” – Vladimir Pantyushin, Head of Research, JLL, Russia & CIS, says. – “Moscow’s ranking fell to 120th during 2015 following two quiet years in 2014-2015. Its rank has subsequently risen as investment volumes increased over the last year. If this performance is maintained Moscow’s position should continue to rise.”

Cross-border investment

European cities also dominate a ranking of the markets which attract the most cross-border investment compared to their economic size, comprising 10 of the top 12 in the Index. London (1) retains its position as the world’s most active cross-border market, followed by Edinburgh (2), Frankfurt (3), Munich (4), Dublin (5), Amsterdam (6), Paris (8), Prague (9), Warsaw (11) and Berlin (12).

“New World Cities now account for over one-fifth of global cross-border activity, up from 14% 10 years ago and equal to that registered in the ‘Big 6’.” added Kelly. “European New World Cities are attractive to a broad range of global investors due to their appealing combination of transparency, stability and sustainability.”