Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

CBRE GROUP, inc. reports strong financial results for third-quarter 2017

GAAP EPS of $0.58, up 87%

Adjusted EPS of $0.64, up 28%

Revenue and Fee Revenue up 11% and 10%, respectively

Los Angeles, CA

CBRE Group, Inc. (NYSE:CBG) today reported strong financial results for the third quarter ended September 30, 2017.

“We are pleased to produce another quarter of excellent results, with double-digit revenue growth and adjusted earnings per share up 28%,” said Bob Sulentic, CBRE’s president and chief executive officer. “Our performance is the direct result of our focused strategy to produce exceptional outcomes for our clients and the commitment of our more than 75,000 people to executing our strategy.”

“The strength of our performance in the third quarter was broad-based. Each of our three global regions produced solid organic growth. Leasing returned to double-digit growth, and was especially strong in the U.S. Revenue growth accelerated in our occupier outsourcing business, as we continue to capitalize on our commanding position in this growing sector. Global property sales saw healthy growth, despite a generally tepid market for transaction activity, reflecting the strength of our brand and ability to take market share. Finally, we also had excellent performance in both of our real estate investment businesses.”

Mr. Sulentic added: “We continue to see healthy momentum across most of our businesses and regions and are increasing our full-year 2017 guidance for adjusted earnings per share to a range of $2.58 to $2.68.”

Third-Quarter 2017 Results

- Revenue for the third quarter totaled $3.5 billion, an increase of 11% (10% local currency1). Fee revenue2 increased 10% (9% local currency) to $2.3 billion.

- On a GAAP basis, net income increased 88% and earnings per diluted share increased 87% to $196.3 million and $0.58 per share, respectively. Adjusted net income3 for the third quarter of 2017 rose 31% to $219.5 million, while adjusted earnings per share3 improved 28% to $0.64 per share.

- The adjustments to GAAP net income for the third quarter of 2017 included $28.2 million (pretax) of non-cash acquisition-related amortization and $5.1 million (pre-tax) of net carried interest incentive compensation expense. These costs were partially offset by a net tax benefit of $10.2 million associated with the aforementioned adjustments.

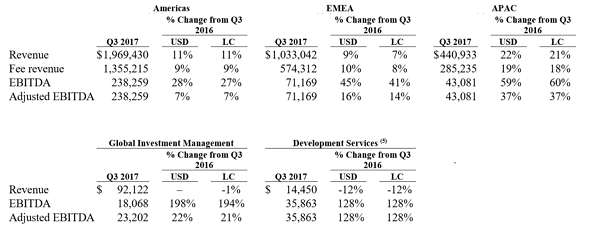

- EBITDA4 increased 43% (42% local currency) to $406.4 million and adjusted EBITDA4 increased 18% (17% local currency) to $411.6 million. Adjusted EBITDA margin on fee revenue increased 120 basis points to 17.7%. The company’s regional services businesses – the Americas, Europe, the Middle East and Africa (EMEA) and Asia Pacific (APAC) – produced combined adjusted EBITDA growth for the quarter of 12% (11% excluding the impact of all currency movement including hedging activity).

- APAC posted a 22% (21% local currency) revenue increase, supported by outsized growth in Greater China, India, Japan and Singapore.

- In the Americas, revenue increased 11% (same local currency), with double-digit growth in occupier outsourcing and leasing. Brazil, Canada and the United States all exhibited strong overall growth.

- EMEA revenue rose 9% (7% local currency), paced by strong gains in the United Kingdom.

- Global occupier outsourcing achieved growth of 14% (13% local currency) in both revenue and fee revenue. Almost all of this growth was organic.

- Leasing revenue rose 13% (12% local currency), with double-digit growth in APAC and the Americas.

- APAC leasing revenue surged 17% (same local currency), with especially strong growth in Australia, Greater China, India and Japan.

- Americas leasing revenue rose 14% (13% in local currency), and 16% in the United States, paced by strong performance in New York City.

- In EMEA, Germany, Italy and Spain led the way to 7% (4% local currency) growth for the region.

- The capital markets businesses – property sales and commercial mortgage origination – produced global revenue growth of 5% (4% local currency) on a combined basis.

- Global property sales revenue rose 9% (same local currency), reflecting market share gains in an environment where global market volumes were relatively flat year over year.

- Commercial mortgage origination revenue declined 12% (same local currency), driven almost entirely by lower gains from mortgage-servicing rights associated with U.S. Government Sponsored Enterprises financing activity, which more than doubled in the prior-year third quarter.

- Recurring revenue from the loan servicing portfolio increased 24% (same local currency). At the end of the third quarter, CBRE’s loan servicing portfolio totaled approximately $165 billion, up 27% from the year-earlier third quarter.

- Property management services produced solid growth of 9% (8% local currency) for revenue and 11% (10% local currency) for fee revenue.

- Valuation revenue increased 6% (4% local currency).

- CBRE’s real estate investment businesses – Global Investment Management and Development Services – produced combined adjusted EBITDA growth of 70% (69% local currency) in the third quarter.

- In the Global Investment Management segment, assets under management (AUM) totaled $98.3 billion, up $10.4 billion, or $2.6 billion excluding the Caledon Capital acquisition, which was completed in August 2017. Positive foreign currency movement added $2.2 billion to AUM versus the prior-year quarter.

- In the Development Services segment, projects in process totaled $5.9 billion, down $1.2 billion from the third quarter of 2016, while the pipeline totaled $5.4 billion, up $1.7 billion in the same period. Fee-only and build-to-suit projects constitute more than 50% of the pipeline.

- Revenue for the nine months ended September 30, 2017 totaled $9.9 billion, an increase of 7% (8% local currency). Fee revenue increased 6% (7% local currency) to $6.4 billion. This growth was almost entirely organic.

- On a GAAP basis, net income increased 70% to $523.1 million and earnings per diluted share increased 69% to $1.54 per share. Adjusted net income for the first nine months of 2017 rose 26% to $586.6 million, while adjusted earnings per share improved 26% to $1.72 per share.

- EBITDA increased 31% (32% local currency) to $1.1 billion and adjusted EBITDA increased 14% (same in local currency) to $1.1 billion. Adjusted EBITDA margin on fee revenue increased approximately 120 basis points to 17.5%.