Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

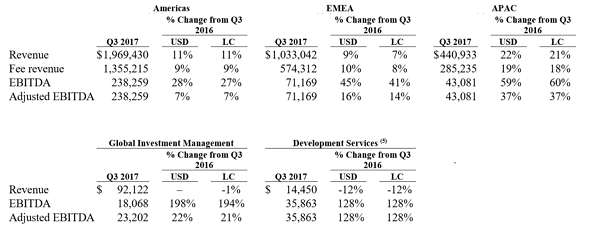

GAAP EPS of $0.58, up 87%

Adjusted EPS of $0.64, up 28%

Revenue and Fee Revenue up 11% and 10%, respectively

Los Angeles, CA

CBRE Group, Inc. (NYSE:CBG) today reported strong financial results for the third quarter ended September 30, 2017.

“We are pleased to produce another quarter of excellent results, with double-digit revenue growth and adjusted earnings per share up 28%,” said Bob Sulentic, CBRE’s president and chief executive officer. “Our performance is the direct result of our focused strategy to produce exceptional outcomes for our clients and the commitment of our more than 75,000 people to executing our strategy.”

“The strength of our performance in the third quarter was broad-based. Each of our three global regions produced solid organic growth. Leasing returned to double-digit growth, and was especially strong in the U.S. Revenue growth accelerated in our occupier outsourcing business, as we continue to capitalize on our commanding position in this growing sector. Global property sales saw healthy growth, despite a generally tepid market for transaction activity, reflecting the strength of our brand and ability to take market share. Finally, we also had excellent performance in both of our real estate investment businesses.”

Mr. Sulentic added: “We continue to see healthy momentum across most of our businesses and regions and are increasing our full-year 2017 guidance for adjusted earnings per share to a range of $2.58 to $2.68.”

Third-Quarter 2017 Results

- APAC leasing revenue surged 17% (same local currency), with especially strong growth in Australia, Greater China, India and Japan.

- Americas leasing revenue rose 14% (13% in local currency), and 16% in the United States, paced by strong performance in New York City.

- In EMEA, Germany, Italy and Spain led the way to 7% (4% local currency) growth for the region.

- In the Global Investment Management segment, assets under management (AUM) totaled $98.3 billion, up $10.4 billion, or $2.6 billion excluding the Caledon Capital acquisition, which was completed in August 2017. Positive foreign currency movement added $2.2 billion to AUM versus the prior-year quarter.

- In the Development Services segment, projects in process totaled $5.9 billion, down $1.2 billion from the third quarter of 2016, while the pipeline totaled $5.4 billion, up $1.7 billion in the same period. Fee-only and build-to-suit projects constitute more than 50% of the pipeline.