Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

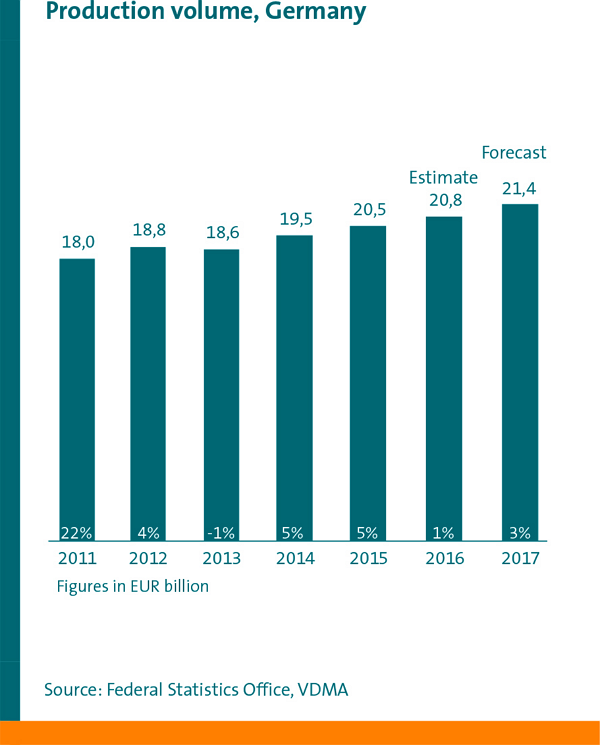

Branch grows thanks to Industrie 4.0

The signs are set for growth: in 2016, the German intralogistics providers achieved an estimated production volume of €20.8 billion (an increase of one percent compared to 2015). "Despite continuing global volatility in international political and economic framework conditions, there is a clear increase in the demand for Industrie 4.0-capable products. Here the German manufacturers convince the market with their high standards of technology and quality in international competition", explains Dr. Klaus-Dieter Rosenbach, Chairman of the VDMA Materials Handling and Intralogistics Association. For the current year 2017, the VDMA Materials Handling and Intralogistics Association is expecting to see growth of three percent on average, with differing rates of development possible in individual sub-branches.

Need for connected solutions

The demand for modern, viable intralogistics is particularly high in the European internal market. Nearly 60% of the total export volume generated by German intralogistics providers goes to other European countries. The German manufacturers increased their exports by 6% to 8.5 billion Euro.

"Industrie 4.0 meanwhile acts like a huge magnet in the European internal market. More and more companies are investing in connected technologies for their production and the associated logistics. This is reflected in the order books of German manufacturers supplying the corresponding solutions", says Rosenbach. Demand in the customer branches such as the automotive industry or e-Commerce remains on a high level. "Together with growth in online retailing, increasingly connected production processes are triggering changes in material flows and supply chains. It takes smart intralogistics to manage these changes", says Rosenbach.

International business

Altogether 2016 saw a slight decline in exports by German intralogistics manufacturers, amounting to a volume of 13.5 billion Euro which is 2% less than in 2015. The key trading partner is still the USA, purchasing goods valued at 1,072 million Euro, followed by France with 898 million Euro in second place and the United Kingdom with 763 million Euro in third place. On the other hand, China slipped back to sixth place with a 28% decline in exports during 2016. "One reason for this is that many German manufacturers meanwhile have their own production facilities in China. On the other hand, there is also a greater trend for Chinese manufacturers to serve their domestic market than in the past", explains Sascha Schmel, Managing Director of the VDMA Association for Materials Handling and Intralogistics.