Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Active office take-up stimulates vacancy rate reduction in key Moscow business districts

Moscow City vacancy rate was record low in Q1 2018

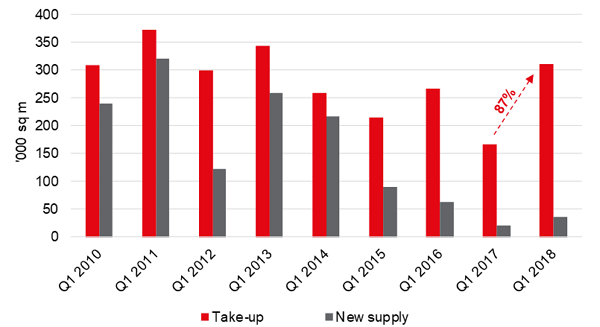

According to JLL, the overall Q1 2018 office take-up in Moscow has increased 87% YoY and reached 312,000 sq m, the highest Q1 volume since 2013.

Trading companies surpassed traditional leaders, banks and finance companies, with 28% of the deals. The second place was taken by manufacturing companies, with 20%. Among the largest deals in Q1 2018 were X5 Retail Group in Oasis BC (9,700 sq m), Stroytransgaz in Vereiskaya Plaza BC (8,800 sq m) and Skylight BC (4,500 sq m), Mistral in Poklonka Place BC (3,700 sq m).

“The declining vacancy and expected start of rental growth support interest in relocations. The Q2 has already started with the largest 2018 deal, Transneft Technology lease in VEB Arena. Taking into account transactions at negotiation stage, we expect the overall 2018 take-up at about 1.4m sq m.” – says Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS.

Take-up and completions in Moscow office market

Source: JLL

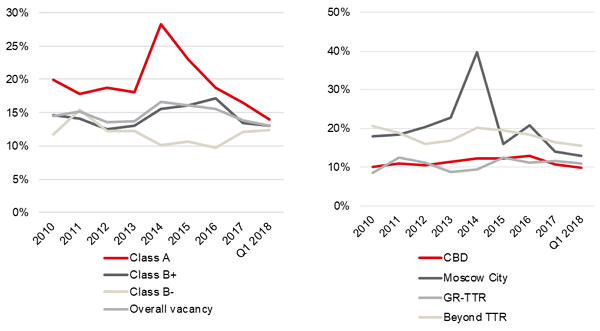

The vacancy rate continued to decline, reaching 13.1%, down 0.7 ppt QoQ and 2 ppt YoY. Low completions and rising demand stimulate the vacancy rate reduction in all quality office segments except Class B-, where the vacancy rate has increased by 0.1 ppt QoQ and by 1.5 ppt YoY to 12.3%. In Class A the vacancy rate has dropped to 14% (by 2.4 ppt QoQ and 3.6 ppt YoY). In Class B+ the vacancy has reached the market average, 13.1% (down by 0.4 ppt QoQ and 3.2 ppt YoY).

The vacancy rate in Moscow City declined by 1.1 ppt in Q1 2018. The largest annual decrease was recorded in this submarket, where the vacancy rate was down 7.5 ppt YoY due to the activity of state banks and public authorities. The vacancy rate reached 12.9%, the record low for Moscow City.

“The Moscow City vacancy rate shrank to a historic low, following the CBD indicators that had already reached the lowest level since 2012 in Q4 2017,” – notes Olesya Dzuba, Head of Research, JLL, Russia & CIS. – “As the new supply tends to decentralise, the vacancy rate is expected to continue declining in key Moscow submarkets, and tenants will have to choose among business centres located beyond the TTR.”

Vacancy rate in the Moscow office market

By class By submarket

Source: JLL

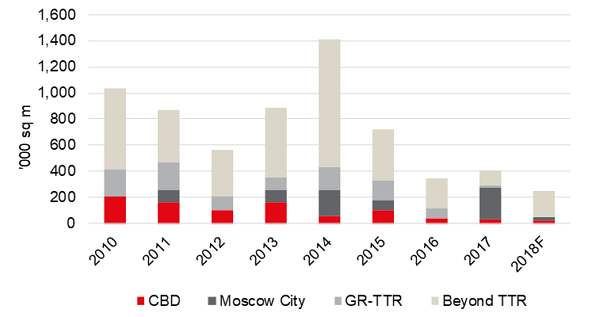

The new supply remains much lower than demand, in Q1 the overall completions volume was only 37,000 sq m. There were no new Class A buildings, and all the new office centres were Class B+. Only one business centre was located in the CBD area, the reconstructed RTS Zemlyanoy Val. The bulk of new completions (84%) were located beyond the TTR, La-5 near the Vnukovo airport, multifunctional complex Park of Legends and the office part of the Faces residential complex near the CSKA metro station.

According to JLL, in the remainder of the year completions would reach 213,000 sq m. The overall 2018 completions are expected at 250,00 sq m (39% shortening YoY), marking the new record low.

New office supply in Moscow by submarket

Source: JLL

Moscow office rental rates remained stable in Q1 2018. Prime office asking rents were USD600-750 sq m, Class A rental rates were RUB24,000-40,000 sq m/year. Class B+ rents were RUB12,000-25,000 sq m/year.