научно-практический

журнал

Новости редакции

Дорогие читатели! Рады представить вам одиннадцатый выпуск журнала в 2025 г. В номере много актуальных и полезных материалов, которые, надеемся, не останутся без внимания.

Научно-практический журнал «ЛОГИСТИКА» официально включен в «Белый список» Российского центра научной информации (РЦНИ). Это значит, что экспертное сообщество подтвердило качество научных публикаций и актуальность исследуемых нашим изданием вопросов.

Президиум Высшей аттестационной комиссии (ВАК) при Министерстве науки и высшего образования Российской Федерации выпустил рекомендацию, согласно которой председателям диссертационных советов при приеме диссертаций к защите нужно проверять количество работ, опубликованных соискателями ученой степени – выпускниками аспирантуры. Рекомендация обусловлена требованиями Постановления Правительства РФ № 842 от 24.09.2013.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

Successful winter season 2017-2018 in Sochi and Moscow Region: steady occupancy growth supports profitability of resort hotels

JLL presents the analysis of 2017-2018 winter season operational results of quality hotel markets of Moscow region and Sochi[1] in a new format. Quality hotels in Sochi are analysed by clusters (mountain and sea) and segments (upper and middle).

According to Tatiana Veller, Head of JLL Hotels & Hospitality Group, JLL, Russia & CIS, "from December 2017 to February 2018, the hotel markets of Moscow region and Sochi displayed stable growth of the main operational indices, continuing to build on the successes of the past several years. Seems like Russian travelers learnt to value the comforts of domestic travel, and started to receive the same value for the money at home as in comparable by the budget locations abroad.”

Sochi

"The past winter has become another outstanding low season for sea hotels in Sochi,” – says Tatiana Veller. – “With a minimum change in ADR of the cluster (was at about RUB6,700), hotels on the seashore managed to fill 44% of rooms on average in December – February vs. 37% in the same months last year. At the same time, in the mountain cluster almost 70% of available rooms were sold, with a slight increase in ADR (by 2%, to RUB8,600).”

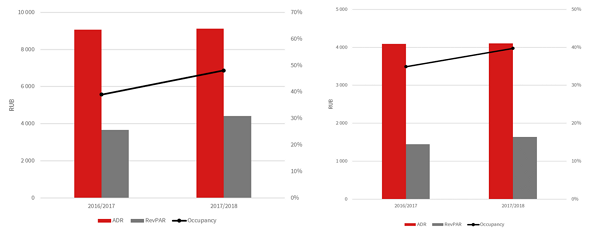

In sea cluster, the best dynamics of the operational indices this winter was shown by the hotels of the upper segments: on the back of rather stable ADRs (about RUB9,000), occupancy increased by 9 ppt in comparison with the previous season and reached 48%. In the middle segments, the occupancy increased by 5 ppt, to 40%, while the ADR remained at RUB4,100.

“The higher-level hotels offer well-developed infrastructure, and in the low season give their guests, who prefer mild climate on the shores of the Black Sea to mountain skiing, more opportunities for entertainment. Probably, this fact can explain the seemingly illogical difference in the occupancy of assets on the seashore.” – says Tatiana Veller. – “As a result, the RevPAR in the sea cluster increased by 21%, to RUB4,400 in the upper segments and by 14%, to RUB1,600, in the middle ones".

Winter Sochi sea cluster hotel market results by segment

Upscale/Upper Upscale Midscale/Upper Midscale

Source: STR, JLL

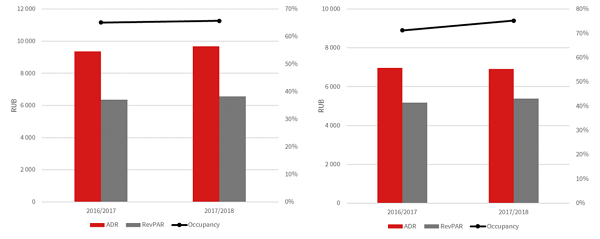

"The summit of post-Olympic years has been reached by the Krasnaya Polyana quality hotels this winter; the occupancy in the upper segments reached 67% (an increase of 0.5 ppt compared to the previous year), and 75% in the middle segments (growth by 3 ppt). This demonstrates the specifics of ski demand: these tourists mainly prefer budget-friendly accommodation and choose a hotel simply as a place to sleep,” – notes Tatiana Veller. – “ADRs were also quite stable here: in hotels of upper segments – RUB9,700 vs. RUB9,400 a year earlier, in the middle segments – RUB6,900 vs. RUB7,000. The result was RevPAR growth of 3-4% in all segments of the southern ski resort of Russia.”

Winter Sochi mountain cluster hotel market results by segment

Upscale/Upper Upscale Midscale/Upper Midscale

Source: STR, JLL

Moscow Region

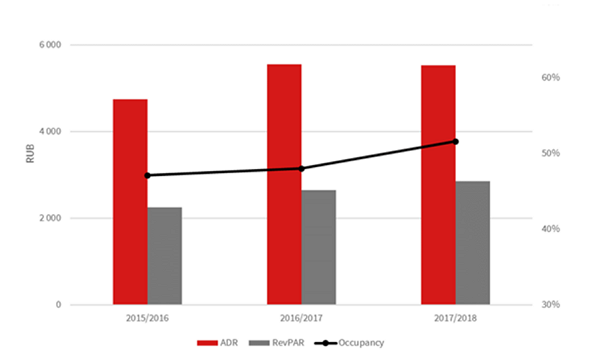

The average occupancy of hotels in the Moscow Region in December-February reached 52%, an increase of 4 ppt compared with the 2016-2017 winter season. The average rate remained stable, at RUB5,500, which supported a further increase in RevPAR by 8%, to RUB2,900.

“The busiest month of this winter was January (with 54% of rooms sold), whereas in the last winter season, due to the effect of early spring, February was the leader in occupancy (56%)." – comments Tatiana Veller. – “The highest rates were observed in January 2018, helped by the New Year holidays, while the ADR in 2018 fell to RUB6,000 vs. RUB6,500 in January 2017.”

Winter Moscow Region hotel market results

Source: STR, JLL

“In the current economic and political environment, highly likely that current trends in the domestic resort hotel markets are here to stay, because Russians continue to vacation ‘at home’. In turn, the domestic hospitality industry is striving to match the growth in demand, by offering more diverse, modern, and unusual hotel and travel product at reasonable for the Russian customer prices.” - adds Tatiana Veller.

[1] The analysis is based on STR data for quality hotels. Upper segments are Upscale and Upper Upscale, middle segments – Midscale and Upper Midscale.