научно-практический

журнал

Новости редакции

Дорогие читатели! Рады представить вам одиннадцатый выпуск журнала в 2025 г. В номере много актуальных и полезных материалов, которые, надеемся, не останутся без внимания.

Научно-практический журнал «ЛОГИСТИКА» официально включен в «Белый список» Российского центра научной информации (РЦНИ). Это значит, что экспертное сообщество подтвердило качество научных публикаций и актуальность исследуемых нашим изданием вопросов.

Президиум Высшей аттестационной комиссии (ВАК) при Министерстве науки и высшего образования Российской Федерации выпустил рекомендацию, согласно которой председателям диссертационных советов при приеме диссертаций к защите нужно проверять количество работ, опубликованных соискателями ученой степени – выпускниками аспирантуры. Рекомендация обусловлена требованиями Постановления Правительства РФ № 842 от 24.09.2013.

Статья недели:

ФОТО НЕДЕЛИ

ЦИТАТЫ

События в российской логистике

Reconstruction has not affected Moscow street retail market yet

JLL analysts present Q3 2017 results on the street retail market

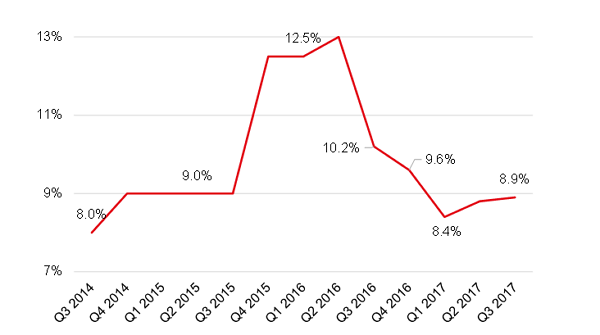

According to JLL, the vacancy rate in the main Moscow high street corridors remained roughly unchanged in Q3 2017 since the previous quarter level, at 8.9% versus 8.8%. Thus, the completion of street renovation works has not yet triggered a rise in occupancy on central retail streets.

Meanwhile, the vacancy rate declined by 1.3ppt since Q3 2016.

Vacancy rate in Moscow high street retail

Source: JLL

The top 3 streets by occupancy remain the same over three quarters, Pokrovka (1.2% of vacant premises), B. Dmitrovka (2.2%) and Myasnitskaya (4.5%). Low vacancy rates were also reсordered on Tverskaya (5.1%) and Nikolskaya (5.3%) streets. Tverskaya Street shows the rising occupancy dynamics, with the vacancy rate there declining by 1.9ppt.

The rise in occupancy was recorded on almost all central streets in Q3, which compensated the vacancy increase on 1st Tverskaya-Yamskaya (from 9.8% to 12.0%) and Pyatnitskaya (from 5.0% to 7.0%) streets.

“As a result of 2017 reconstruction, the exterior of Moscow central streets have been renovated. This has reduced the attractiveness of Pyatnitskaya Street, which was renovated in 2014. In Q3, the length and remoteness of Pyatnitskaya Street affected its performance, leading to a rise in vacancy and a drop in average rental rates. Moreover, the street profile has also changed on the back of the traffic concentrated in several locations. These include the part between Novokuznetskaya metro station and Klimentovsky Lane, while other segments of the street have become less attractive,” – Ekaterina Andreeva, Capital Markets and Retail Analyst, JLL, comments.

As a result, rental rates on Pyatnitskaya street declined from RUB110,000 per sq m per year in Q2 2017 to RUB85,000 in Q3 for the first time in two years.

Rental rates increased on Novy Arbat (from RUB115,000 to RUB120,000) and Nikolskaya (from RUB140,000 to RUB150,000) streets. Nikolskaya Street joined the list of top-3 most expensive corridors in Q2 and solidified its position in Q3.

“All Moscow key retail streets are renovated now. Retail tenants adjust their location preferences, focusing on those with the highest footfall. Nikolskaya Street has been attracting tenants since the beginning of the year due to its proximity to the Red Square. The number of historical sites and metro stations nearby generate high pedestrian traffic. These drivers attract tenants of different formats, from mass market to luxury. This means that Nikolskaya Street is attractive for stores and restaurants of different concepts targeting high footfall. The rental and vacancy dynamics indicate a high potential of the corridor,” – notes Natalia Ozernaya, Deputy Head of Street Retail in Moscow, JLL.

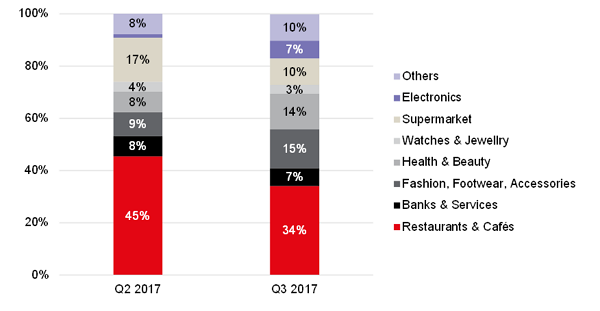

On the demand side, Restaurants & Cafés traditionally remained the leaders in the central retail corridors, with a 34% share of all leasing requests. Fashion operators returned to the second place, with their share rising from 9% in Q2 to 15% in Q3 2017. Other segments posted slight recovery in tenant inquiries.

Demand structure in Moscow high street retail

Source: JLL

After the completion of street renovation works, access to some premises on the central streets has improved, making them attractive for leasing. This drove up rotation on Moscow retail corridors, from a 4% average in Q2 2017 to 9% in Q3. The largest share of new tenants appeared on the Garden Ring (where rotation went up to 29% in some areas); while the lowest share of tenant changes was recorded on Stoleshnikov Lane and Pokrovka Street (2% each).