Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

Moscow shopping centre vacancy rate declined to 7.2%

According to JLL, with no new shopping centres delivered to the market in Q1 2017, the vacancy rate in existing properties declined from 7.5% to 7.2%. Over the course of the year, JLL analysts expect this indicator to decline further, to 6.5%, the lowest level since the beginning of 2015.

Some 217,500 sq m of new quality shopping centres[1] are announced for delivery in 2017, which is 52% lower than the 2016 volume and the lowest level in the past four years. The main properties expected later this year are Vegas Kuntsevo (113,400 sq m) and Vidnoe Park (27,500 sq m).

“The volume of new shopping centre supply in Moscow has been declining since 2015. Developer activity moderated considerably during the recession; projects were frozen at various completion stages.” – Ekaterina Zemskaya, Regional Director, Head of Retail Group, JLL, Russia & CIS, says. – “This year started with an announcement of realization of such previously suspended projects as Salaris (105,000 sq m) and Galeon (14,000 sq m), as well as construction plans of brand-new projects, in particular Vegas on Kievskoe highway. As economy stabilises, we expect further recovery of development activity that will restore positive completion dynamics in 2018-2020.”

“The focus of developers is changing with a gradual market saturation by traditional shopping centres and rising competition. There is a growing interest in neighbourhood shopping centres, which not only focus on the daily needs of residents, but also offer cultural and leisure components. The share of such projects in the future supply will increase mainly as a result of ADG Group’s reconstruction and reconception of 39 Soviet era cinemas (324,000 sq m).” – Polina Zhilkina, National Director, Head of Retail Advisory, JLL, Russia & CIS, notes. – “At the same time, construction of transport interchange hubs incorporates shopping complexes. For instance, Seligerskaya (145,000 sq m), Cherkizovo (120,000 sq m), and Park Pobedy TPUs. Such projects will form the bulk of the new retail supply from the beginning of 2019.”

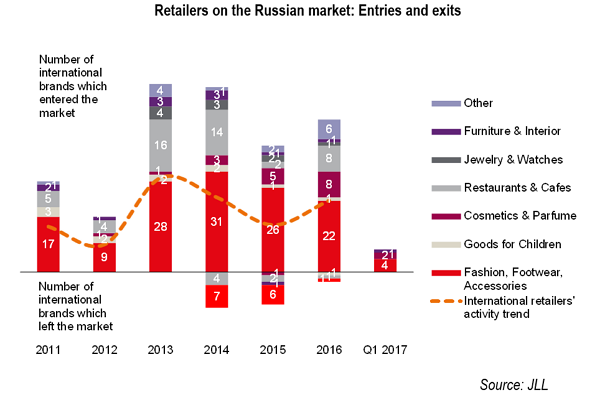

The Russian market continues to attract new international retailers: seven new brands appeared in Q1 2017, Aquazzura, Zanellato, Peter Kaiser, Japonica, Giorgio Armani Beauty, Eglo, and Ahimsa. Most of the newcomers represent the premium segment. The most notable event among the first quarter debuts was the first European opening of Italian cosmetics boutique Giorgio Armani Beauty in Atrium. The only brand opening in street retail – on Petrovka Street – was that of Italian luxury shoes store Aquazzura. Street retail traditionally attracts flagship stores of global brands, with Q1 marked by such launches as flagship Nike store (the third overall and the first in Europe new concept store); a Massimo Dutti store appeared on Kuznetsky Most Street; H&M opening on Tverskaya Street was announced for Q2 2017.

“It is too early to call a start of the consumer sector recovery.” – Margarita Shebanova, Retail Market Analyst, JLL, Russia & CIS, adds. – “Although consumers, along with other market players, adjusted to the current conditions, their incomes continue to decline. Nevertheless, the expected improvement of retail turnover and real disposable income dynamics (by 2.3% in 2017, according to Oxford Economics) will support further improvement in retail leasing activity.”