Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

- CBRE analyses luxury segment in Russia -

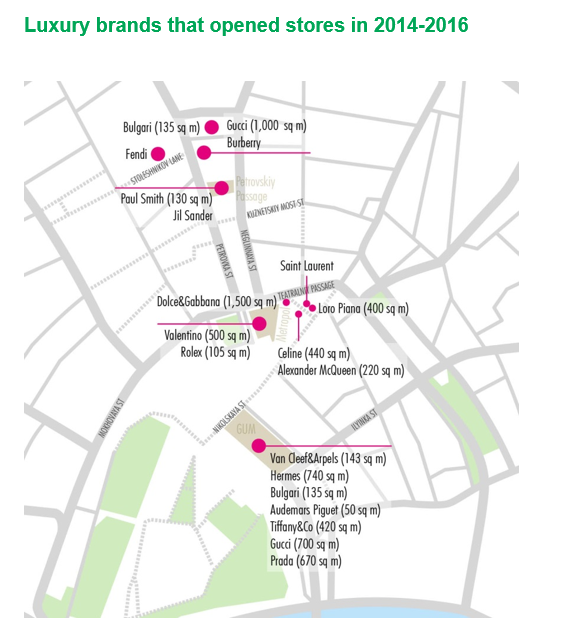

- 29 new luxury brands opened their stores in 2015-2016 in Moscow -

Moscow

According to the findings of the latest research from CBRE, the global property advisor, luxury goods market in Russia demonstrated stability in 2016, mainly due to a shift in demand, influx of Chinese tourists and reduced prices from a number of retailers.

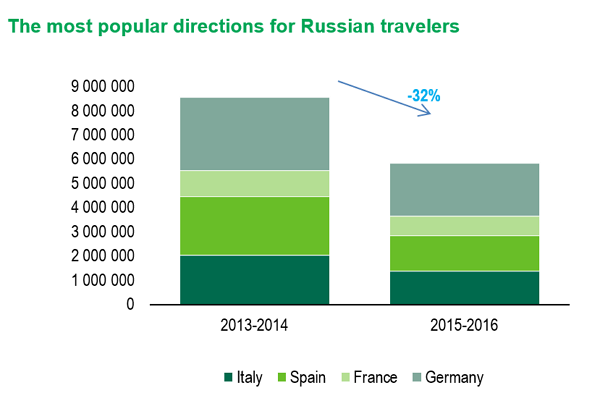

On the back of the crisis and income decline the number of Russians traveling to Italy, Spain, France, and Germany declined by 32% in 2015-2016 compared to 2013-2014. Consumers started to spend money inside the country, including luxury clothes and shoes.

Source: Rosstat, CBRE, Q4 2016

The report showed that the reduced prices (10-25%) for luxury goods from the largest retailers made Moscow competitive to Milan. The prices in Russia are lower than in Asia. This step led to the increased number of purchases by foreigners, mainly by Chinese tourists.

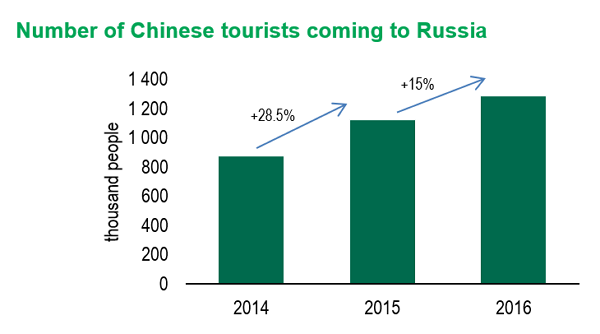

On the back of the formed comfortable conditions (signage and services in the Chinese language) and preferences (tax free, option to use China UnionPay, visa-free travels by groups of 5-to-50 people for up to 15 days) for the Chinese, number of tourists from China increased by 28.5% in 2015 and 15% in 2016.

Source: Rosstat, CBRE, Q4 2016

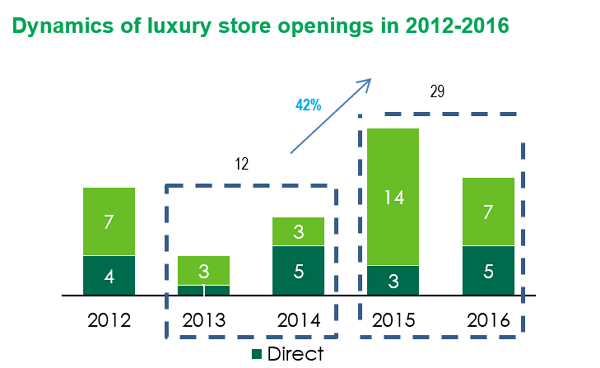

Despite the downturn in the economy, Russia remains one of the key markets for almost all global luxury brands. This is reflected in new stores openings, as well as in the expansion of the existing stores. About 42% stores opened in Russia during 2015-2016 compared to 2013-2014. Among the brands that turned into direct operation for the last three years are Bvlgari, Gucci, Burberry, Tiffanу&Co. and Hermes.

Source: Rosstat, CBRE, Q4 2016

Source: CBRE

Olesya Dzuba, Head of Research, CBRE in Russia commented:

“With 73% of luxury retailers present in the market Moscow ranks 7th along with New York, Osaka and Taipei in terms of global luxury presence giving way to Shanghai, Dubai, London, Hong Kong, Tokyo and Singapore. Moscow is also among the ten most attractive cities for luxury retailers together with London, Melbourne, Doha, Dubai, Prague, Honolulu, Gold Coast, Bucharest and Ho Chi Minh. The emerging economic recovery will stimulate interest from luxury brands to the Moscow market”.