Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

On the back of strengthening operational performance, Kiev starts to receive new branded hotel rooms again

JLL presents the Q1-Q3 2017 results of the quality hotel market in Kiev, Ukraine.

According to JLL observations, the quality hotel market of the Ukrainian capital displays persistence on continuing on the path to recovery. “Hoteliers are hopeful, the occupancy has almost climbed back up to the normal for Kiev levels (46% YTD, 7.6 ppt higher than the previous year so far). The international, MICE and cultural events are starting to fill up the city again, bringing in big groups and guests to the hotels, and tourists seem to return to this undoubtedly interesting cultural and historic leisure destination.” – Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says.

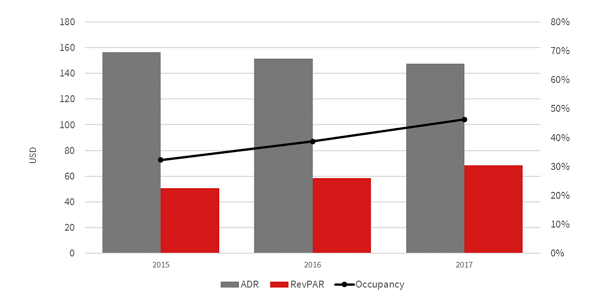

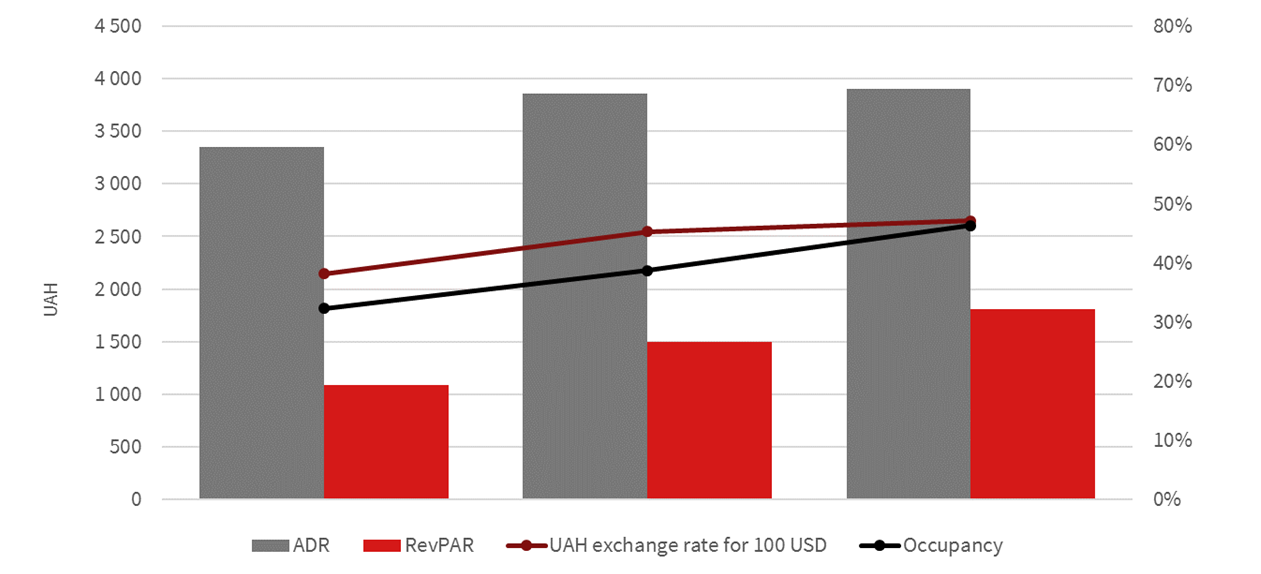

The USD rates in quality hotels in Kiev have been relatively stable (so far having only lost 2.5% off the ADR since the beginning of the year), and in January – September having reached $148. JLL experts suspect that this is more an artificial loss, due to the local currency fluctuations, rather than a real drop in rates. Hryvnia-denominated rates are slowing growth, but still show a positive trend – 1.2% gain YTD, to roughly 3,900 UAH. Trying to book a room on the touristic portals like Booking.com shows that the intentions of the hotel managers are set on keeping the prices high, especially now, when the demand started to recover.

Q3 YTD Kiev quality hotel market results in USD

Source: STR Global, JLL

RevPAR continues to demonstrate positive trends, first of all due to the Occupancy growth. YTD in USD terms YoY it increased by almost 17% (to $68), in local currency – by 21% (reaching 1 800 UAH).

Q3 YTD Kiev quality hotel market results in local currency vs. UAH-USD exchange rate

Source: STR Global, JLL, National bank of Ukraine

“This year is also the first time in three years that we should witness any internationally-branded hotel openings in the Ukrainian capital, and this shows that the investors trust that the bottom of the economic cycle has been reached, the stability settled in, and that it only looks up from here. We have seen Park Inn Troitskaya, first Park Inn in Ukraine enter the market in Q3; in early Q4, the first Mercure started receiving guests (rebranding of a former Cosmopolite hotel), and there is also a first in the country Aloft announced for opening before the New Year comes. If all announced hotels open doors, this will increase the branded hotel rooms offering in the Ukrainian capital by 664 rooms of which 352 already started receiving first guests.” – Tatiana Veller adds.