Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

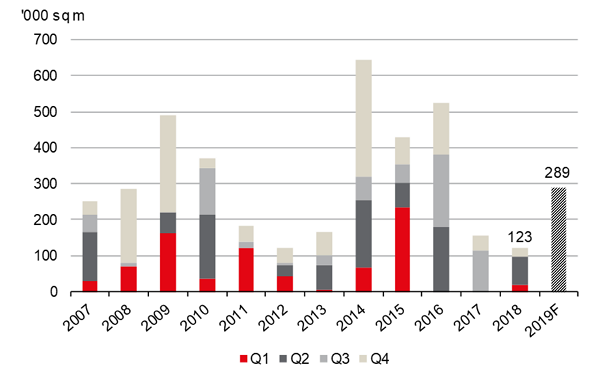

With 60% of new projects expected in 2018 delayed, Moscow retail market completions drop near a record low

123,000 sq m entered the market, out of 306,000 sq m announced

MOSCOW

According to JLL, 2018 Moscow shopping centre completions amounted to 123,000 sq m[1], only marginally above the 2012 record low of 120,000 sq m.

The new 2018 supply consisted of Kashirskaya Plaza SEC (71,000 sq m), Milya in Zhulebino (19,000 sq m) and Petrovskiy SC (8,500 sq m) opened in H1 and two projects delivered in Q4, Arena Plaza SC (17,000 sq m) and Krasnoprudny SC (about 7,000 sq m).

Shopping centre completions in Moscow

Source: JLL

Low completions are the result of several postponements, including Ostrov Mechty SC, Rasskazovka TPU, Galeon SC, the second phase of Smolensky Passage MFC and several local ADG group schemes, all of which were initially announced for 2018.

As a result, 289,000 sq m of new deliveries are expected in 2019. The dominant projects this year will be Salaris MFC and Ostrov Mechty SC, together accounting for 61% of forecasted completions.

“Due to a limited supply of quality shopping centres and increasing competition among retailers, the trend of combining different services and goods has strengthened. There is an active collaboration of formats and concepts, such as shops with cafes, coworking spaces with cafes, shops with playrooms for children, entertainment with education, and so on,” – says Ekaterina Zemskaya, Head of Retail Group, JLL, Russia & CIS. – “Apart from that, well-known brands are testing new formats. For instance, to be closer to its consumers, IKEA has opened small size design studios, in Aviapark SC and in the residential complex LIFE-Botanicheskiy Sad.”

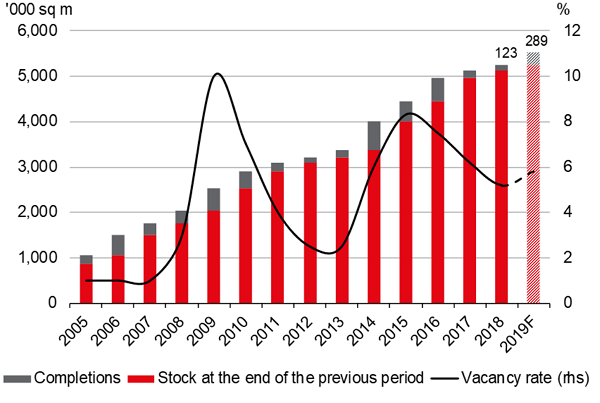

Because of low completions and a lack of available quality retail space the vacancy rate in Moscow has continued to decline, reaching a five-year low of 5.2%, 1 ppt down since end-2017.

“The declining vacancy throughout last year originated mainly in such shopping centres as Mozaika, Riga Mall, Butovo Mall. Besides, occupancy improvements were demonstrated by new schemes, delivered after 2016. For example, in 2018 the Riviera SEC vacancy rate declined to 3% from 8%; in Vegas Kuntsevo SEC to 8% from 15%," – notes Oksana Kopylova, Head of Retail and Warehouse Research, JLL, Russia & CIS.

Taking into account the expected completions in 2019, the vacancy rate is projected to rise slightly, to 5.8%.

Shopping centre completions and vacancy rate in Moscow

Source: JLL

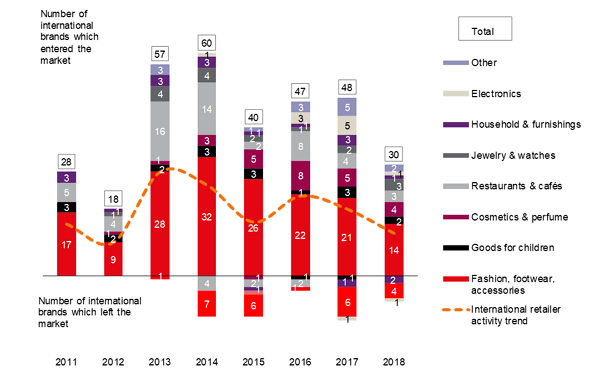

The inflow of new international retailers declined in 2018, with only 30 entering the Russian market against 48 in 2017. This marked a six-year minimum. Seven international brands left the Russian market vs nine in 2017.

The majority of 2018 newcomers are representatives of the premium segment (53%), while in 2017 middle segment brands prevailed, with 46% of the total number. In 2018 the middle segment has accounted for 40% of debuts. Among prominent entries last year are mono-brand stores of That's Living, COS, Karl Lagerfeld and Coach.

Retailers on the Russian market: entries and exits

Source: JLL

In 2019, a number of international brands are expected to enter the Russian market. American brand DreamPlay intends to open an entertainment centre in Aviapark SC. Chinese retailers such as fashion brand Urban Revivo and sportswear brand Li Ning are also expected to debut in 2019. In addition, fashion retailer Mеxx announced its return to Russia.

[1] This and other figures refer to gross leasable area (GLA).