Scientific & Practical Journal

Editorial News

Dear readers! We present to you the first issue of 2026, in which we have collected a number of interesting materials on issues of modern logistics.

We are pleased to present to you the final issue of the journal in 2025 and inform you that LOGISTICS is opening a new page in its development by starting cooperation with the Crystal Growth Foundation, which means that the information saturation of the publication will change for the better. The first issue is dedicated to one of the innovative domestic developments, AI-Kantorovich, which the Crystal Growth Foundation created together with Hive Mind AI.

Dear readers! We are pleased to present to you the eleventh issue of the journal in 2025. There are a lot of relevant and useful materials in the issue, which, hopefully, will not be ignored.

PHOTO OF THE WEEK

CITATIONS

All News of Logistics

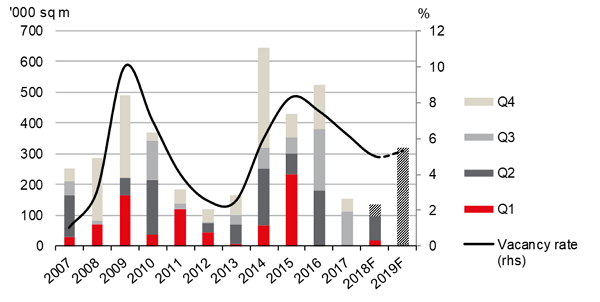

2018 Moscow shopping centres completions are heading towards a six-year low

Delayed launches of several projects brought the expected volume down to 137,000 sq m

According to JLL, Moscow shopping centre completions amounted to 98,000 sq m[1] in the first nine months of 2018, which is 13% lower than in the same period of last year. No new schemes have been delivered in Q3 2018.

The new supply this year consists of three shopping centres opened in H1 2018, Kashirskaya Plaza SEC (71,000 sq m), Milya in Zhulebino (19,000 sq m) and a neighbourhood Petrovskiy SC (8,500 sq m).

Three more shopping centres are announced for delivery by the end of this year, Arena Plaza (17,000 sq m), Galeon (14,000 sq m), and Krasnoprudny (about 7,000 sq m). The retail scheme within the Rasskazovka TPU and Angara SC are among the projects rescheduled for 2019. As a result, the total annual completions will amount to 137,000 sq m, 12% lower than last year.

“An additional 38,000 sq m of new quality retail supply is announced for delivery in Moscow by the end of this year, one-third of total annual completions. However, even if all these projects are launched, the annual result will be the lowest in the last six years,” – says Ekaterina Zemskaya, Head of Retail Group, JLL Russia & CIS. – “We continue to observe low new retail supply due to the 2014-2016 recession. Yet, there is on-going construction, and two large projects, Dream Island and Salaris, are expected to enter the market in 2019, along with several ADG group neighbourhood shopping centres. As a result, the deliveries will more than double next year, to 321,00 sq m..”

Shopping centre completions and vacancy rate in Moscow

Source: JLL

The vacancy rate in Moscow quality shopping centres continued its downward trend. It declined to 5.0% in Q3 2018, 1 ppt lower than in the same period last year. The lack of new supply and high occupancy rate at the opening of new shopping centres will keep the vacancy rate at a four-year low of around 5.0% for the remainder of the year.

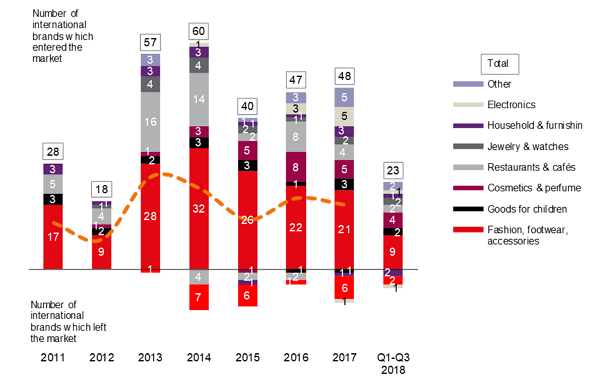

The interest of new international retailers in the Russian market has moderated this year. Some 23 new brands entered Russia versus 38 debuts in 2017; five international retailers left the market this year.

“The Russia economy is recovering after the economic crisis in 2014-2016. However, rouble depreciation and limited supply of prime locations are recognized as major constraints for expansion of international brands,” – notes Oksana Kopylova, Head of Retail and Warehouse Research, JLL Russia & CIS. – “Only seven new brands have entered the Russian market in Q3 2018; all of them opened their first stores in Moscow. Among the prominent entries is the return of Sephora, which has opened its flagship store in Aviapark SC. The first fast casual outlet of the American chain Panda Express serving Chinese cuisine has opened in MEGA Khimki.”

Nevertheless, several major international retailers plan to open their first mono-brand stores in Russia later this year. The Swedish fashion retailer COS will debut in AFIMALL City, DreamPlay by DreamWorks is about to appear in Aviapark. CJ CGV, the fifth largest cinema operator in the world announced its opening in 2019, as well as a major fashion retailer Mexx, which contemplates a return to Russia.

Retailers on the Russian market: entries and exits

Source: JLL